This week: “I am a 28-year-old working in music as an artist manager. I love my job and have been working there for four years – it’s really exciting and fulfilling but I have recently started to feel fairly restless about the salary. I came from a job that I hated because of a bully boss and awful company culture so I worry that leaving my current role would put me back in a similar position of mega stress and sleepless nights. Is it worth it for a better salary?

Given the current climate, I have been incredibly lucky to be able to keep my job. The company didn’t furlough any staff, even though they lost 60% of their income during the pandemic, with live events being the biggest missing chunk of income for the business.

I did cheekily ask for a pay rise in March to £30k (from £25k), which they gave very understandable C-related reasons against but met me in the middle at £27.5k.

I do often get asked what an artist manager is and the simplest explanation is that we handle the business side of our clients’ careers (both in a day-to-day and long-term sense) so that they can focus on making music and touring. We help to plan album projects, orchestrate tours and releases, create marketing strategies, run social media accounts, build merch businesses… It’s pretty varied!

I live with my fiancé, T, in our two-bed flat in east London that we bought a couple of years ago due to both being in an extremely fortunate position of having received inheritance, which paid for the deposit. We also have a lodger, who will be moving out soon. We will really miss that spare income.

T and I split all the monthly house/car costs proportionally to our salaries, and then everything else (e.g. food shop, petrol) is split 50/50. We use Monzo and have an ongoing shared tab so we balance each other out with spending.”

Industry: Music

Age: 28

Location: London

Salary: £27,500

Paycheque amount: £1,750

Number of housemates: Two (we get £700/m from the lodger for rent + bills)

Monthly Expenses

Housing costs: Mortgage is £1,270 (shared expense). As T and I split house and car costs proportionally to our salaries, my contribution to this is £750, which I put into our joint bank account each month – I’ve pointed out below the shared costs that this goes towards.

Loan payments: Car loan £215, 0% financing for a wardrobe £400 left to pay (both shared expenses). Student loan, a laughable £1! The income threshold has increased each year so this is the first year that I’ve had to start (sort of) paying it… Not that it’s even touching the interest.

Utilities: Monthly: gas and electricity £65, council tax £130, water £26, internet £26, contents insurance £12, car insurance £48, British Gas HomeCare £23, TV licence £12.87. Yearly: £150 ground rent to freeholder (we live in a Victorian maisonette) and £300 building insurance (all shared expenses).

Transportation: Our car costs £48/m for insurance, £200/y for tax and approx £50/m in petrol (shared costs).

Public transport: I’m currently spending approx £20/m on Tubes (in normal times, I would spend about £100. I have a Young Person’s Railcard attached to my Oyster card so I get a third off travel off-peak.

Phone bill: I recently switched to a SIM only contract after finishing paying off my phone so I now only pay £6.50/m. I am waiting for the next iPhone drop in the hope that the 12 is cheaper by then – I can’t bring myself to pay over £40/m for a phone.

Savings? Our savings have been pretty depleted since buying a property. We cover the mortgage/bills between the two of us and we have been using the lodger income to slowly do up our flat. We’ve now done most of what we wanted to do so this income has very recently started going towards our wedding fund. We have just started to each put £150/m into our joint savings account and I try to save £100/m into my personal savings account. Joint savings is currently £1,500, personal savings is £2,500.

Other: My parents have a family account on Spotify and T’s parents have all of the video subscriptions so we’re lucky to be able to leech from them on these. Gym/swimming membership £59/m, yoga £35/m, magazine subscription £4.50/m, cleaner £16/m for my share – we all put money into a kitty for this (including the lodger). Weekly bread delivery £3/w (shared expense with T).

7.10am: WHY is the alarm going off so early?! T reminds me that it’s because he has to go into the office today to meet a client. We have a morning ritual of taking it in turns to make tea to have in bed first thing and he kindly offers to take my turn today. Tea and chats while I read through the news: my favourite part of the day.

8.30am: I get up and pull on my gym clothes. I don’t feel like going but I have booked a class and would get charged £3 if I cancel – this is always enough motivation to get me in there! Before I leave, I pull some chicken out of the freezer; we need to do a food shop but I really don’t feel like it today. We tend to do one big shop a week – the last shop was exactly one week ago but I think we can last a couple more days with what’s in the fridge/cupboard…

10.10am: I get home after a sweaty AF spin class and check in on my emails before having a quick shower. Someone’s used up the last of the soap so I crack open my Herbal Essences shampoo for the job! Make a mental note to pop out for soap later.

11am: I make myself and lodger some coffee. I can honestly say that one of the top five purchases of my life was a proper coffee machine, which we treated ourselves to earlier this year. I am not nailing the latte art just yet but enjoying giving it a go.

11.30am: My first call of the day luckily doesn’t take too long so I then knuckle down on my inbox. A lot of my work involves being the middleman between the handful of artists that I work with and third parties (press, labels, publishers, designers) so there’s a lot of back and forth.

1pm: I make a tuna salad and sit at my laptop to do some personal accounting admin over lunch. I like to do this after payday to feel on top of finances. I log in to my bank account and transfer £600 from my main account to Monzo, which is my monthly ‘allowance’ – this would be for food shopping, meals out, pub trips, clothes shopping. If I have anything left over on Monzo at the end of the month, I transfer it to my savings account.

1.45pm: I spend the rest of the work day answering emails and working on some projects.

4pm: Pop out to buy shower gel and bubble bath – I wishfully go into Holland & Barrett for the fancy stuff but quickly remind myself that this month is a five-week gap between paydays and opt for some less fancy options in Asda as well as some bananas (£3). I get home, make a cup of tea and continue working for a bit longer.

6.30pm: T is on his way home so I start cooking the chicken and a random assortment of vegetables that are in the fridge. There’s a half bottle of red wine left over from the weekend (seriously unusual for us) so we obviously have to finish it off with dinner. Finish binge-watching the This Is Pop docuseries on Netflix that we started last night and I browse wedding invitations, ordering some samples (£0.95).

9pm: An evening at home isn’t complete without a bath so I run one extra hot ‘n’ bubbly.

10pm: Happily get into bed and read until I doze off.

Total: £3.95

7.15am: Early alarm again. Groggily make the tea and jump back into bed with T for another half hour. It is pouring outside and I am reading about the current heatwave in the Nordics. It’s July and I can barely remember what the sun feels like on my face!

7.45am: I get up and walk to a morning yoga class for a good stretch. I’ve been really making the most of exercise classes since they’ve reopened. In the Jan-Mar lockdown I lost all motivation as I was sick of trying to work out alone in my living room. It’s been such a buzz to be back in front of an instructor and in a room of people.

9am: On my way home, I remember we’re almost out of coffee so I pop over to our local roaster to pick up some beans and they grind them the right amount for my machine. It costs £8 but I split it on Monzo with T and lodger (£2.66).

9.30am: I eat a kiwi and then settle down to start work on an international tour budget for one of my clients. I’ve not worked on one of these since the start of the pandemic and feel a flutter of excitement at the prospect of gigs and touring. T offers to make the coffee this morning.

12.30pm: I usually have a team call at this time every week but it’s been cancelled today. So I am making the most of it and head out to my favourite gym class, which I’m only able to attend on these rare occasions that the call is off. While I do miss the office, I mostly really enjoy this newfound flexibility that comes with working from home.

1.30pm: Some girlfriends are coming over for dinner so I pick up some food on my way home to make a curry (£15.50). I get home absolutely starving so grab some leftover salad from yesterday to have for lunch and start cracking on with some social media asset designs for a client.

6pm: I suddenly realise I am still in my gym kit so have a quick shower before the girls arrive, then start to make dinner.

10pm: A lovely evening but already regretting all of the wine. The girls leave and I wobble towards bed.

Total: £18.16

7.30am: I don’t know why I thought I felt groggy yesterday; today is going to be a slow day! Luckily I can stay in bed a little longer. T makes some tea and while in bed I scroll through Instagram and see that a friend is putting on a charity event so I buy two tickets for myself and T (£15 for my half).

8.15am: Shower, hair wash and I stick on the washing machine. The rain has finally stopped and it makes such a difference being able to hang the washing to dry outside with a bit of solar and wind power. Our flat is a fairly good size but doesn’t have a lot of spare floor space with three of us working here too.

9am: I head out for a quick nurse appointment to get my blood pressure taken for my pill prescription. It’s become much less of a hassle during COVID: the doctor gives a consultation over the phone and automatically sends the prescription over to the pharmacy.

9.30am: I get to my desk and start work. I have no Zoom calls this morning, a breath of fresh air.

1pm: Thrilled about having leftovers for lunch, T heats up some curry from last night. While eating, I decide that as we still have the lodger income coming in, we should pay off the £400 left of the 0% finance loan for the wardrobe so I transfer that money over to the lender (£200 for my half). It feels good to have paid it off.

1.30pm: I hate it when I don’t really leave the house much in a day so I pop out for a short walk around the park and then return to my desk for a load of calls this afternoon.

6pm: T and I head out to buy some beers as the football is on tonight and we have a couple of friends joining (it may be a different case by the time you are all reading this but for us right now: it’s coming home!). T pays for this and puts it on the Monzo tab (£5 for my half).

7pm: I start making a pasta dish for dinner with a sofrito and bacon sauce – another eating up everything in the cupboard/fridge sort of dinner. Then we settle down to watch the match.

11pm: As I head to bed, I can hear such a noise of horns, fireworks and cheers outside. I’m not usually into it but after the past 16 months I can’t help but feel delighted at the football cheer that’s around at the moment (minus the hooligans).

Total: £220

7.30am: I wake up and see that I’ve been refunded £68 from ASOS (ka-ching). The good thing about online shopping is that I never like most of it IRL.

8am: Okay, I can’t put off the weekly shop any longer – the only thing left to eat are some chicken nuggets in the freezer. I am usually pretty partial to a nugget or two but I’ll save it for the weekend! I start going through recipes and writing up a meal plan for the next week as it keeps it cheaper and means we tend to eat a little healthier.

8.45am: I feel in a bit of a funk today. I’m not even hungover! I try to shake it off by putting on some good music and faking some pep. It sort of helps.

9.30am: I start to prep for a big meeting that I have this morning, which is an A&R session with one of my artists. He recently sent us his first demos for his next album. I’ve spent a week listening to them, writing down my thoughts and now have to think carefully about how to discuss my notes on the demos in a constructive way.

1pm: We have some (more) leftover curry for lunch – I can’t believe I got eight servings out of it! After lunch, I finally head to the supermarket and do the week’s shop. We are having some friends over for a BBQ on Sunday so I spend a little more than we usually would, a slightly eye-watering £101. Our usual weekly shop is around £60-70. (£50.50 for my half.)

2.15pm: I get back and T helps me put the shopping away. I get back to work for the rest of the afternoon, feeling super snappy at annoying emails. Sigh!

6pm: I jump on the Tube (£1.85) to meet one of my best friends for dinner as she’s about to go away for a few weeks. We mooch through some shops for a bit, having some good chats and finally getting me out of The Funk. We settle on a place for dinner. After a fairly expensive couple of weeks, I’ve been trying to go out for meals less but nothing beats it (£22.56).

9pm: Quite happy to get home early (Tube £1.85), I get ready for bed and read until I fall asleep.

Total: £76.76

7.30am: I’m sure it’s my turn to make tea this morning but I wake up to T bringing in a cuppa. He’s been waking up really early recently, I think we need better curtains!

8am: The doorbell goes and it’s our bread delivery aka my favourite time of the week. It only costs £3 including the delivery – London, what! This came about in lockdown with a local baker who started baking bread from his kitchen and cycles around to drop the bread off to customers. We always immediately chop off the crusty ends and slather it in butter…such a treat! I’ve already paid for this week’s.

9am: I see some slightly urgent emails come in so I start work a little early this morning.

10.15am: Another ring at the doorbell and it’s British Gas. We’ve had really irritating humming pipes for weeks but couldn’t get an appointment until today. We have to pay a call-out fee but the rest is covered by BG – this really saved us when we first moved in and had endless issues with the boiler. We have genuinely saved a lot of money by having this cover. (£30 for my half.)

10.30am: I take it all back. We just wasted £60 on the call-out because it’s a plumbing issue and we don’t have plumbing cover (big facepalm). We’re so useless when it comes to things like this!

12.15pm: After a couple of days off from exercise, I cycle over to a lunchtime yoga class. It feels good to be back and stretching again. I quickly forget about the £60.

1.30pm: I get back home, eat some leftovers from T’s dinner last night and get back to work. Unless there’s a music release out, Fridays are usually fairly quiet but I seem to have a load to do today.

3.30pm: We’re having steak tonight but I only bought enough booze for Sunday in the weekly shop so T suggests we pop out to buy a bottle of red to go with it. On the way, we stop off at the pharmacy to pick up my pill prescription. T pays for the bottle of wine and adds to the Monzo tab (£4.25 for my half).

4pm: We get home and crack open a beer to finish the day’s work.

6pm: Laptop off and it’s the weekend! I am trying to save myself up for a big day on Sunday so my weekend plans are to have an evening in with T tonight, followed by some much-needed me-time tomorrow as it’s a rare occurrence that both T and lodger are out.

7pm: We cook up a feast of salad, steak and T’s best homemade chips, followed by settling down on the sofa to watch Good Morning, Vietnam. We both fall asleep before the end but manage to drag ourselves from the sofa to bed.

Total: £34.25

8.30am: Finally, a lie-in. I can never sleep in for long but it’s just nice to know that you don’t need to be up for anything. I make some tea and get back into bed with a magazine.

9.15am: I am quite a creature of habit on a weekend morning so I go and make my favourite smoothie (one kiwi, one orange, two bananas, two frozen spinach cubes, four cavolo nero, handful of frozen berries and one litre of water, thank me later), followed by a slice of sourdough with butter and jam.

10am: T suggests we go for a walk. We’re lucky to live pretty close to a forest on the outskirts of London so we drive there and walk for an hour.

11.30am: I pop out to the local market. It’s one of the best things about the area I live in, and also London in general – there are always plenty of weekend markets. The park is bustling with various stalls and food trucks. I slightly regret having had a big breakfast (I would’ve been first in the queue for a Deeney’s haggis toastie). As I walk past a stall, I can’t help but buy a sausage roll for lunch (£3).

1.30pm: I get home and run a bath. The only thing better than an evening bath is a candlelit day bath!

3pm: After quite some pampering, I start working on wedding planning. I’ve been pretty relaxed about it so far, mostly because I have no idea where to start, but recently keep getting reminded that next year is going to be quite a funnel of weddings post-COVID. I love planning and I love parties – how hard can it be?!

6.30pm: I can’t believe that this will be the third time that I write the word ‘nugget’ in this Money Diary but I am going to cook up some chicken nuggets (fourth time) for dinner tonight, with some salad and peas for good measure.

8pm: I’m really letting you into the intimate details of my home alone me-time now: homemade popcorn. None of the microwavable crap but kernels popped on the stove. It takes a bit of practice but once you nail the kernel popping and get the perfect balance of butter, a sprinkle of sugar and a touch of salt, you can’t go back!

11pm: One film and one episode of High: Confessions of an Ibiza Drug Mule later, I am ready for bed.

Total: £3

8.30am: I wake up to a slightly hungover T lying beside me. I leave him for a bit and start prepping the food for later. We’re having a very OTT, complicated menu for the BBQ today. I am making four different salad options (why?) and T is going to cook chicken on the BBQ. Unusually for east London, there is only going to be one vegetarian so we have some veggie sausages and burgers for him. I get cracking on the salads.

9pm: I pause to take a cup of tea into T, followed by the usual smoothie.

11.30am: Food all prepped so I go out into the garden to do some weeding and tidying. After it being a total mess for two years, we’ve finally got it looking really smart and it’s been worth every penny and minute spent on it. T pulls out all of the garden cushions from the shed.

1pm: Our friends start arriving and we all enjoy the wine and feast in the sunny garden. It feels like the first sunny day in weeks!

6pm: The group have various plans for tonight’s football match so the others get going and we finish clearing up.

6.30pm: Another friend of ours managed to score a table last-minute in a nearby pub so T and I get the Tube there to watch the game. (£1)

11.30pm: A few too many glasses of orange wine later and T pays our part of the bill and adds it to the Monzo tab (£25 for my half). It wasn’t a win tonight but a fun evening all the same. Shattered after a jam-packed day, we jump on the Tube home. (£1)

Total: £27

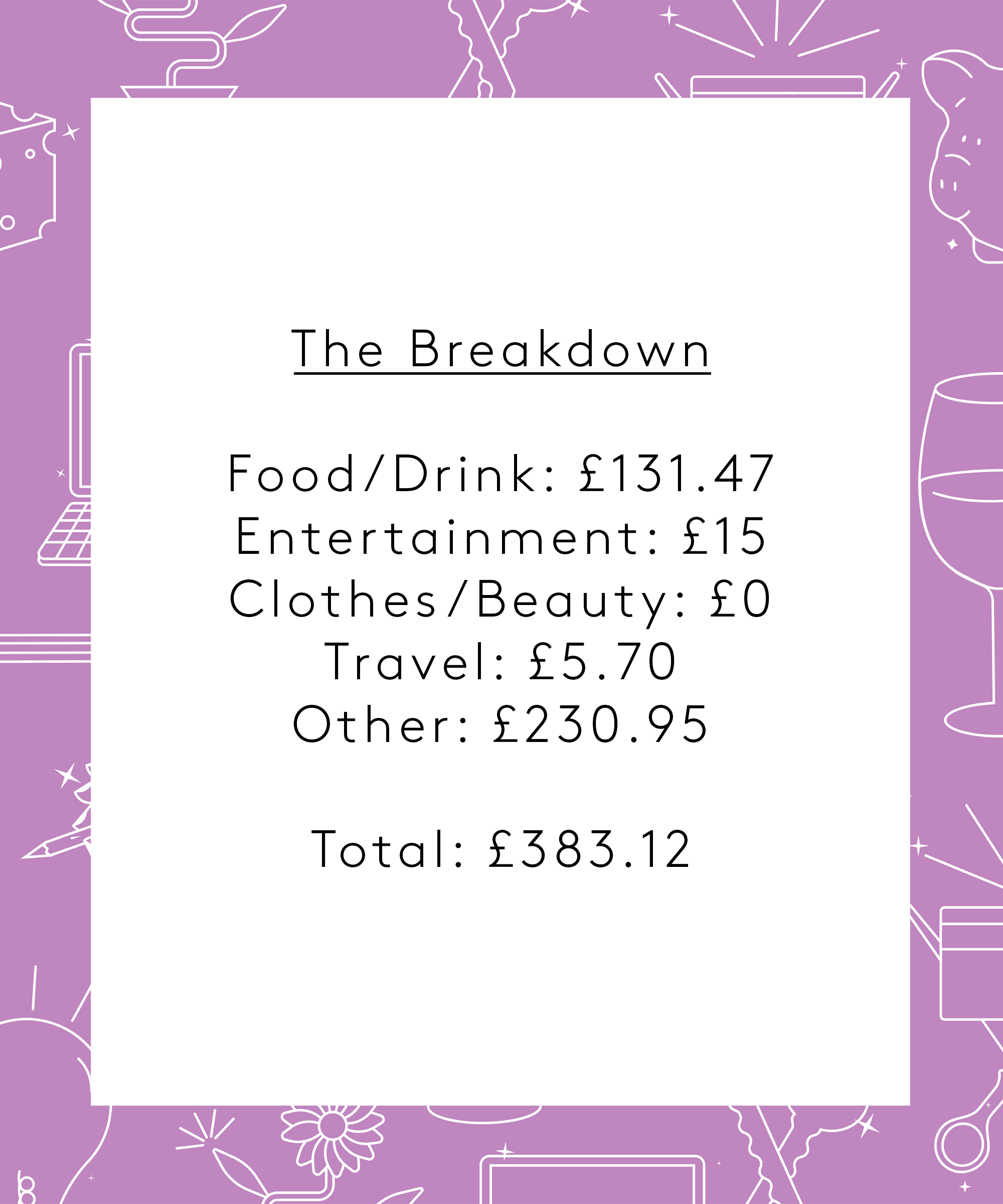

Food/Drink: £131.47

Entertainment: £15

Clothes/Beauty: £0

Travel: £5.70

Other: £230.95

Total: £383.12

Conclusion

“There have been a couple of unusual expenses such as paying off the wardrobe loan and the call-out with British Gas.

We’ve hosted three times, I had one meal out and one evening out in the pub. So it’s been quite a busy and slightly more expensive week (I blame the football). I will mellow out next week and make up for the excessive spending.

Lockdown has definitely made me become more of a home bird but once live events are back, T and I will be out much more for work. I think we’re going to have to be a bit careful as life will be very different when we don’t have the lodger income and are also trying to save up for a wedding. I love the lifestyle that we currently have though, so if I want to be able to afford everything, I do need to seriously consider moving jobs (and sadly probably move industries too). Some tough decisions ahead!”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A Software Engineer In Gaming On 52k