This week: “I’m a 27-year-old train signaller living on the border of Surrey and Hampshire. I moved here four years ago after starting on a graduate scheme with my current employer, then moving into railway legal advice and now signalling. My partner, A, moved into my old rented flat with me after I’d lived there for a year (thanks, Tinder). He also works for the railway and we both do shift work/weekends. When it comes to money, I’m very impulsive. As soon as I decide I want or need something, I start looking immediately so that I can tick it off the ‘to buy’ list. I used to try and get things as cheaply as I could but now I have more disposable income I’ve started valuing my time more, meaning I don’t mind paying extra for a gym that’s closer, turning down overtime that’s not paid at a higher rate and paying extra for faster shipping. Little things but they all add up!”

Occupation: Train signaller

Industry: Railway

Age: 27

Location: Surrey, UK

Salary: £65,000 with overtime

Paycheque amount: £3,000-4,000

Number of housemates: My boyfriend (A) and my two cats (J and G)

Pronouns: She/her

Monthly Expenses

Housing costs: £680 mortgage.

Loan payments: £0 (my student loan is automatically taken from my salary).

Pension? I pay 6% of my salary and my employer pays 8%. This is taken before tax/NI. I’ll be changing it to the railway final salary pension once I’m eligible this summer.

Savings? Around £1,000-2,000.

Utilities: A pays for the household bills as I own the house and pay the mortgage (this totals around £120 for council tax, £30 for water, £100 a month on our electric meter and £50-£100 for gas).

All other monthly payments: £30 phone finance, £18 SIM only contract. Car tax £12, cat insurance £20, home insurance £9, union membership £20. Annually I pay £500 for hair extensions.

Did you participate in any form of higher education? If yes, how did you pay for it?

I took a gap year then did a law degree. It was fully funded by student finance and I got the maximum living cost grant/loan too. I debated doing a Legal Practice Course after but couldn’t justify the cost vs how much I actually wanted to practise law. Even though I don’t need a degree for my current job, I wouldn’t have got to this point without one.

Growing up, what kind of conversations did you have about money?

My parents always taught me the value of money and I had a paper round as a teenager, then started my first job at 15. I don’t remember talking about money much but I knew that branded clothes etc. were a luxury and not a necessity.

If you have, when did you move out of your parents’/guardians’ house?

I moved out when I was 18 while I was at uni. I used my student loan and worked part-time at Sainsbury’s to support myself. I did move back for a few months at a time when I was ‘between houses’ up until I was about 24.

At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?

The same time that I moved out, when I was 18. I’ve worked ever since then and made enough to support myself but my mum has always let me know that she’s there if I ever get stuck.

What was your first job and why did you get it?

When I was 15 I got a part-time job at a milkshake bar (earning £3.68 an hour!). I stayed there for four years alongside college and a couple of other part-time jobs. I wanted my own money to spend on non-essentials rather than having to justify to my parents why they should give me money.

Do you worry about money now?

Not so much in my current job due to the disposable income but I did in my last job, especially when I lived alone and had the rent to pay. It doesn’t help that I’m an incredibly impulsive spender.

Do you or have you ever received passive or inherited income?

My mum gave me £10k for the deposit for my house, which she inherited last year. I’ve offered to pay it back but she says she doesn’t want me to.

9am: Wake up to our cats singing their breakfast song.

10am: It’s my boyfriend’s birthday in a couple of weeks so I decide to buy him a 90 Day Fiancé (so addictive) themed birthday card from Etsy for £3.69. We went to Dublin last month as his present (and I played b*witched on repeat for two weeks solidly afterwards) but I want to get him something small to open on the day. I settle on a “What a sad little life Jane” (iconic Come Dine With Me moment) T-shirt from Amazon for £12.99.

12pm: Head to the gym (it’s the poshest one I’ve ever belonged to and it really does help motivate me to go).

1.15pm: On my way back I stop at the dump to get rid of a rotting dressing table that’s been in my boot for what seems like months. A was going to make a catio out of it but that looks unlikely to happen so I made an executive decision to get rid of it. Free because I booked in advance. What a sad little life.

2pm: Eat some Thai vegetable soup (I batch-cooked 18 meals on Sunday – me and A don’t eat the same things because of shift work and me being veggie) and then sprint to work. Despite only living a 15-minute walk away, I’m always dangerously close to being late. Request to do some overtime next week. I try to do two Sundays and two rest days a month. Sundays are awful shifts because it’s often 12 hours of looking after a closed railway line but it’s mega bucks.

10pm: Come home and have Chinese curry noodles for dinner.

11.30pm: Sleep.

Total: £16.68

10am: My friend who was having a party at her house on Saturday texts to say she has COVID and has to cancel. I cancel my pre-booked taxi and get the £25 holding fee refunded. I debate cancelling my annual leave but decide I should find something exciting to do instead. I’ll probably end up on the sofa, eating crisps and drinking cheap wine. Actually that sounds quite fun.

11am: We booked flights to Bali (eeek!) last week, using my credit card for the added protection. A transfers me his half and I pay it off, £705 each. We travelled quite a bit during COVID and it’s great to see more places opening up.

12pm: Go to the gym to distract myself from the amount of money I’ve just spent. Instead of just feeling guilty, I’m now feeling sweaty and guilty.

2pm: Head to Boots on my way to work to pick up some insulin. I recently moved from injections to an insulin pump, which is great but definitely a learning curve. The only perk of type 1 diabetes is having a medical exemption card for prescriptions.

3pm: Take leek and potato soup to work.

10pm: Get home and have vodka pasta for dinner (not as fun as it sounds). Let J lick the bowl clean. That cat is a walking dustbin.

Total: £705

10am: Get to work and immediately remember I’ve forgotten to bring any form of food. Dash to Sainsbury’s and pick up some veggie soup for £1.69. Fight the urge to stop at Costa too.

12pm: Buy a fish pond cat toy from Amazon for J and G, £18.98. I feel guilty because we left them for 10 days last month while we were in Sri Lanka (my mum came to feed them every day) and will be doing it for Bali in June too. I’m making up for it by extending the toy collection.

6pm: Me and A have a rare evening off together so we snuggle up with J and G and watch trash TV. I drink some wine from my mega monthly food delivery as I’m off work tomorrow.

10pm: Sleep.

Total: £20.67

11am: Make a smoothie bowl because it makes me feel like *that girl* then drive to Essex because it’s filler and Botox day! I get filler once a year (in various parts of my face) and it’s my first time having Botox (it’s a preventative measure, right?). I always go to the same salon. It’s around an hour and a half’s drive away but much cheaper than anywhere nearby while still doing fab work. I have the money set aside from my last paycheque for the filler and I paid a £100 deposit last month. The total comes to £380 for the filler package and £190 for the Botox. My BA Amex card arrived today so I use that to pay in the hope that one day I’ll have enough points for a first class upgrade where I can chug fancy champagne.

2pm: Get home swollen and starving so have some leek and potato soup from the freezer. I’m not meant to exercise for a couple of days after the Botox so I walk to Tesco instead of going to the gym. I decide to be super organised and get A a birthday cake and some candles, along with some crunchy sticks for the cats. £18.29

4pm: Hide them all when I get home and know I will almost definitely forget where I’ve hid them when I need them.

10pm: Sleep.

Total: £588.29

5am: Wake up and wonder why early shifts start so bloody early. Try to get ready while simultaneously holding frozen peas on my hilariously swollen lips. I don’t even want to mention my cheeks (I look like I’ve got golf balls tucked up in them). I forget how cold it still is this early in the morning and order some gloves on Amazon while I walk to work. £3

10am: Someone at work covers me so I can head to the doctor’s opposite for a blood test. I stopped taking the pill in December and my period is nowhere to be seen so I want to check nothing sinister is going on. (Possible TMI: I got my period as soon as I got home from work, like my uterus realised it was time to stop catfishing me.)

11am: Stop at the shop on the way back to get an energy drink in an attempt to make my brain forget about our early wake-up time, £1.59. Feel about 15 years old, walking down the road with a can of Monster, but needs must.

2pm: Finish work and stop off at the sun bed shop (I know, I know, it’s hideously bad for your skin, I’m just hoping to keep my tan topped up until Bali). Use the credit on my account.

2.30pm: Stop and get beers to have with A tomorrow evening as we’re both off, £3.95. Realistically I’ll probably drink them tonight.

3pm: Devour some vodka pasta once I’m home. I don’t eat until I’m home when I’m on early shifts. Too tired for the gym so I go for a walk. I get lost almost immediately – every house in this estate looks the same.

5pm: Have ratatouille for tea.

7pm: Wake up on the sofa (early shifts always mean an accidental nap) to G meowing because there is only room for me and J on it.

7.30pm: There are tons of ceiling hooks screwed into the plaster all over the house which I’m too DIY-inept to remove so I order a hanging cat bed from eBay to hang from the one above the sofa, £11.99. Unlikely they’ll ever use it but we’ll soon find out.

10pm: Sleep.

Total: £20.53

9am: Wake up, day off, lovely.

1pm: Drive to meet my friend in a quaint little village nearby to do the Jane Austen circular walk (turns out not cancelling my annual leave was a good idea). I tried to do this one last summer but we got lost and ended up on a dual carriageway.

3pm: On my way back I stop at the car wash outside work and get an inside and outside valet, which turns out to be an awful idea because I feel like my womb is about to explode. All worth it for the free air freshener. £22

8pm: Have a bath and listen to a podcast (I love The Bitch Bible and Guys We Fcked at the moment). I also order a book from Amazon to see me through my night shifts next week, £2. I haven’t read the blurb, just saw it was highly rated, so it’ll be a surprise. I usually get books from charity shops because they’re so cheap but I won’t have time to go before Monday.

9pm: A gets home and we have some beers and shisha. The beers gradually turn into rum and cokes – yikes.

12am: Bed.

Total: £24

10am: Woooow I drank more last night than I was planning. I feel fine today but everything was very spinny when I was trying to sleep last night. I also drunkenly bought a double hammock for the garden (I’d been looking for one for a while so it’s not too shocking). £45 in three instalments with Klarna.

1pm: My parents come over and I finally get to give my mum her belated Mother’s Day card (it’s a picture of Phil Mitchell captioned “Mum you Phil me with joy”) and some wine. It’s the first time I’ve seen my dad for months. I love him, of course, but he truly is the weirdest person I’ve ever met. Sometimes I wonder if he’s even a real person…

2pm: I drive us all to a village nearby for an Indian buffet lunch, the others take beer and wine as it’s bring your own booze. I pay for us all as a belated Mother’s Day treat. £57

10pm: I’m on night shifts from tomorrow for the week so I buy myself a ridiculous-looking eyelash extension-protecting sleep mask online, £4.60. I do enjoy night shifts but the novelty will wear off soon I think. At the moment I still think of it as a slumber party except you don’t get to sleep and instead of playing truth or dare you operate a massive train set.

11.30pm: Try and stay up as late as I can to prepare for tomorrow and make it until the grand old time of 11.30pm.

Total: £106.60

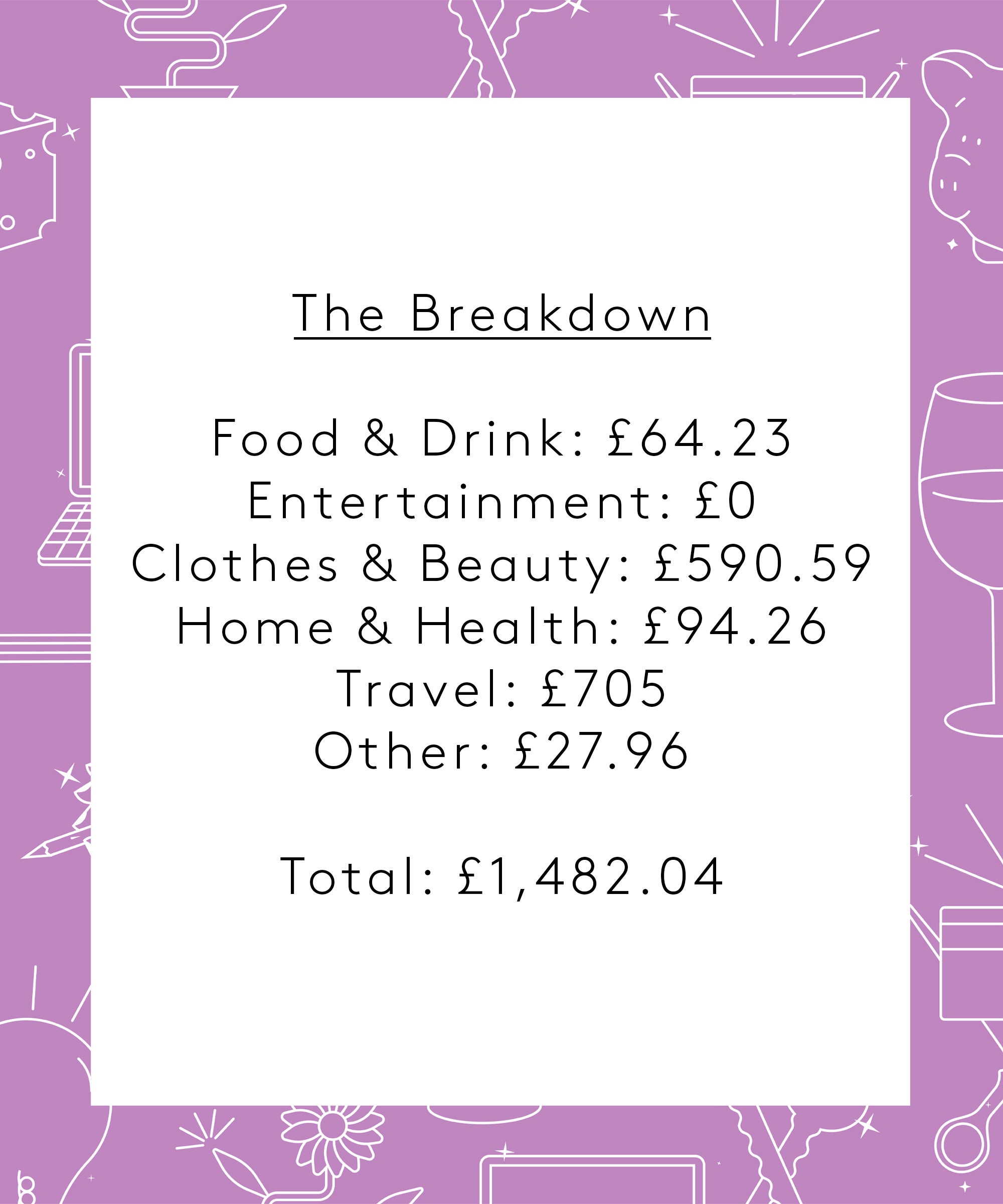

Food & Drink: £64.23

Entertainment: £0

Clothes & Beauty: £590.59

Home & Health: £94.26

Travel: £705

Other: £27.96

Total: £1,482.04

Conclusion

“This definitely wasn’t a normal week in terms of having two big purchases: the flights and the filler. I usually spend more on food but meal prepping last week really helped keep this down. Also, I usually spend more on fun but being on late shifts puts a stop to this. I get one ‘long weekend’ of six days off in a row per month, which is when I spend the most on entertainment, so it does even out. I know I’m a very impulsive spender and tend to ‘buy now, worry later’.”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A Lead NHS Nurse In Yorkshire On 40k