This week: “I’m a 30-year-old portfolio manager living in London. I recently moved jobs to a completely different industry, which added a further £25k in salary, and I feel very grateful for the job that I have now. I used to be a splurger and I would say I’m still an emotional spender although I work really hard not to spend recklessly nowadays. My husband and I are currently in the middle of buying our first home together. After getting married I moved into his one-bedroom flat so we are really excited to be buying something bigger together. We’ve really utilised every space we possibly can within the flat! We also want to make the most of our time together before we start a family in the next year or two so that sometimes means saying yes to nights out and late nights, holidays and eating out.”

Occupation: Portfolio manager

Industry: Broadcast and media

Age: 30

Location: London

Salary: £72,000 + bonus

Paycheque amount: £3,663 (my bonus is paid in March and I haven’t received one yet).

Number of housemates: One: my husband, T.

Pronouns: She/her

Monthly Expenses

Housing costs: £600 to cover my half of all expenses, which I put into a joint account for day-to-day spending for groceries, petrol, etc. T pays the mortgage and bills.

Loan payments: £232 car loan, which I will finish paying in April. £372 student loan, which comes off my gross pay.

Pension? I pay 3% and my employer pays 6%. It’s around £180 per month.

Savings? £83,000 sitting in my current account. I will use this for our deposit and stamp duty in a couple of months when we exchange.

All other monthly payments: £10 phone bill, £25 gym, around £14 contact lenses. £13 a month for my Nationwide current account, which also covers roadside assistance, phone and travel insurance. I give my mum £100 every month just to help her out a bit but I’ll most likely have to stop this once we have bought a house. Subscriptions: £20 for a couple of charities, £13.99 Spotify Duo, £4.99 Apple TV.

Did you participate in any form of higher education? If yes, how did you pay for it?

I went to university and took out a student loan. My parents gave me around £120 a month and I eventually got a weekend job in retail to get some additional money in my pocket.

Growing up, what kind of conversations did you have about money?

We didn’t really have conversations about money. When I started earning money I was told to rein in my spending and to save, however my parents didn’t really set a good example for me as they had a lot of arguments revolving around money. This situation made me want to work really hard in recent years so I wouldn’t have to worry about money. Both my parents worked but one parent earned more than the other and that created a lot of friction (the breadwinner made not just financial decisions but all the decisions within our family, which was toxic). When I met my now-husband he really taught me a lot about personal finance and helped me to save better.

If you have, when did you move out of your parents’/guardians’ house?

Last year when I got married, at 29.

At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?

I lived with my parents until I was 29 so I never had to worry about a mortgage or rent, which I am super grateful for. This allowed me to save as much as I did while going on holidays, buying large purchases and generally not having to worry about spending. I helped pay for big purchases at home, food shops and takeaways until I moved out last year.

What was your first job and why did you get it?

When I was 18 I worked as a sales assistant at a shoe shop.

Do you worry about money now?

Yes and no, I worry about the high mortgage payments we are now tied to for the next five years but I know we will be okay. Even though we both earn the same, my husband is more of a worrier than me over money and I generally have the approach that we will make it work somehow. I would say that I am ambitious and hardworking so I am determined to work really hard and progress at work so that I can jump salary in the next few years. Luckily I work for a great company that does regular salary reviews, bonuses and promotion panels so I am hoping that my salary rises in the next year or so.

Do you or have you ever received passive or inherited income? If yes, please explain.

My dad kindly gifted us £35,000 for our stamp duty. I also got £10,000 when my grandparents passed away. Without this, we wouldn’t be able to buy a home this year.

7.30am: Wake up for a day of work at home. It’s Friday and T is working from home too. It’s nice to spend the day with him after a busy week of being in the office.

12.30pm: We pop out to run some errands and leave the car at home to get some steps in. It’s a lovely day so I’m not too reluctant. I’m usually super lazy!

1.30pm: Grab lunch at Pret as our errands took a little longer than we thought. £7.52 for my half from our joint account.

5pm: Get an email from work about a tech programme I’ve been wanting to get into. It’s a programming course so it’s very much out of my comfort zone but I’ve wanted to broaden my skill set so I will definitely apply.

6pm: Log off and lie on the sofa after quite a tiring day. Fridays should not feel like this! I buy a foundation I’ve had my eye on from Rare Beauty, £26.

7.30pm: Order some Chinese food before we head out for a night out with friends. I need to line the stomach as I refuse to have another hungover weekend. T pays.

9pm: Order an Uber to our friend’s for pre-drinks, £17.38.

10.30pm: After having a few drinks we decide to make our way to the event we are going to. We are having such a great time just catching up and drinking with our friends indoors that now I cba to go out into the cold.

10.45pm: Grab an Uber to the event. T kindly pays for this for me and two other friends.

11.15pm: Arrive at the event. One of the girls who came with us (who is a friend of a friend) doesn’t get in so there’s some drama. We eventually have enough of waiting around so we go and get ourselves drinks and get on the dance floor.

Total: £50.90

3am: We’ve had a good night but T and I are tired. It turns out everyone else is too so we all decide to leave and get Ubers home. £13 for my half.

4am: Arrive home and have the leftover Chinese food. I realise I haven’t spent any money on drinks tonight. I ask T how much I owe him and he says it’s fine, which is super nice of him. I take off my makeup with makeup wipes (yuck I know), brush my teeth and get into bed.

10am: Wake up with a horrible sore throat (no hangover though!). I message in our group chat for everyone to send photos from last night.

12pm: I drive to my parents’ house to spend a couple of days there. It’s only the other side of London but it takes about an hour and a half. London traffic is really something else.

1.30pm: Have a delicious South Indian lunch made by my mum. Her cooking is the best but obviously I am biased.

2pm: Pass out on the sofa while watching She-Hulk with T and my brother. I order my usual shampoo from Amazon as I find it is cheaper on there than where I usually get it from, £18.21.

3.30pm: Get ready to go for our second viewing of the property we are purchasing. We are so excited! Our offer got accepted last week and since then things have moved along so quickly and we can’t help but start planning for all the things we want to do to it. We were in a chain for the last eight months on another property and recently pulled out due to the seller taking her time, along with multiple interest rate hikes. We have now gone for something more affordable with no chain.

5pm: We spend over 45 minutes at the house, asking the owner loads of questions and just taking our time really taking it all in. It’s a little smaller than we’d like but there is a lot of potential to really make it our own.

5.30pm: Drive to T’s sister’s as they have invited us over for food. I get a coffee from McDonald’s on the way as my throat is on flames, £1.89.

10.30pm: Have a lovely evening with everyone including my sister-in-law’s super cute puppy. The downside is I am now feeling super run-down. We head back to my parents’ and go straight to bed.

Total: £33.10

5am: My razor throat wakes me up. Try to get back to sleep but I can’t, boo.

9.30am: After nodding off for about half an hour, I wake up again. T brings me some tea, toast, Nurofen and Strepsils. He really is an angel.

10am: We cuddle in bed for a bit.

12pm: Get myself out of bed and feel horrendous. I wonder if it’s COVID but with no tests to hand there is not much I can do. I shower and go downstairs to get out of my germy room.

1pm: T goes to play badminton without me. I really could have done with the running around after a weekend of carbs and booze.

3pm: Wake up from a nap. I have some biriyani for lunch but I’m pissed that I can’t enjoy it as I have no appetite. This is the first Sunday in months where we have zero plans. I’m so glad I can just take it easy and have a generally chilled day.

4pm: My friend M messages me to say she’s also super ill after Friday night. We defo caught whatever this is off each other, whoops.

8pm: We get back to the flat after an hour’s drive. We have Pot Noodles for a quick dinner as we are both not very hungry.

9pm: Unpack and do a little tidy up and then wind down to get into bed. I really hope I feel better tomorrow!

Total: £0

8am: Aaaaand I still feel crap. I’m going to have to take a sick day today. I tell my manager I’m unwell and he says I sound horrendous and not to worry about work.

1.30pm: I have some lunch of leftover cauliflower steak but I can only muster a small portion. I watch House of the Dragon while eating. I’m loving this show so far but it seems to have gotten a little slow.

5pm: I pop out for a little walk for some fresh air and most importantly to grab some Viennese swirls, Twirl bars, eggs, tiger bread, soup, baked beans and loo roll. £8.92 for my half.

7pm: Make dinner of garlic mashed potatoes, chicken sausages and roasted tenderstem broccoli. We start Inside Man on BBC iPlayer and we finish all four episodes. David Tennant is as always brilliant!

11pm: After doing some reading on my Kindle (I’m currently reading How To Kill Your Family and it’s really made me enjoy reading again), I do my skincare routine, which I’ve been neglecting. I cleanse with The Body Shop cleansing butter, A313 retinol, Sunday Riley Juno night oil and Laneige lip balm.

11.30pm: Brush my teeth and get into bed.

Total: £8.92

7am: Wake up and lie in bed for an hour until T wakes up. I read my book on my Kindle, hoping it will allow me to doze off but it doesn’t. My coughing fit eventually wakes T up.

8am: I order my contact lenses as I have run out, £14.72.

9am: Log onto work after showering. My hair is washed and I feel like a new woman.

10am: I get a refund for some trainers I bought last week that gave me painful blisters. £57 into my account, yay.

1pm: After a few hours of work, I break for lunch. I have leftover garlic mashed potatoes, cheese and broccoli escalope with a nice dollop of sriracha mayo. I catch up on TV while eating.

2pm: I leave for my scalp PRP (platelet-rich plasma) appointment. I’ve been experiencing a lot of hair loss in recent years and after trying various options I’ve decided to take the plunge and do injectables. I use my contactless for the Tube, which will come out of my account tomorrow.

4.50pm: Wow, that took a lot longer than I thought and it was painful! They basically take out my blood, spin it in a machine and inject it into my scalp. But I’ll take the pain for luscious, thick hair again, £250.

5.30pm: Arrive home and catch up with T. We chat about what’s happened on the house front. We agree that our solicitors need to be chased regularly for any kind of progress, which is very annoying. T makes me a cuppa with some biccies as a treat for having bloods taken.

6pm: My manager from my old job messages to say to pop over to hers for coffee next week so pencil that in my diary. I catch up on emails and Slack messages.

6.30pm: Since I’ve been feeling poorly T won’t let me go to the gym yet, which is probably a good idea. So we go for a walk and pop into Currys to have a look at TVs and refrigerators to get an idea of what we can buy when we eventually move. It’s so hard to not get excited!

7.30pm: Grab some smoked salmon, milk, bath soak and hand wash on the way home, £4.11 for my half.

8pm: Arrive home and have tomato soup and toasted tiger bread with smoked salmon.

9pm: I realise I haven’t checked in with friends this week so make a mental note to call my friend A tomorrow, whose call I missed over the weekend. I also message N, who’s now in her third trimester, to see how she’s getting on.

9.40pm: After doing some more reading on my Kindle I do my usual skincare routine and get into bed for an early night.

Total: £268.83

7.45am: T wakes up before me for a change and he isn’t even going into the office. I take full advantage of having a whole bed to myself for about 20 minutes before I decide to get myself to the shower.

8am: £6.50 comes out for TfL travel.

10am: Finish morning stand-ups and change into gym clothes. I’m going for a legs, bums and tums class this morning. I’m looking forward to it as it’s been a while since I’ve done a class. I’m hoping the instructor goes easy on me.

11am: I get back from the class, it was great to move and sweat after being ill. I shower up and get ready for my 12pm call.

11.30am: I order a Stasher snack bag, a Pyrex measuring jug and my vitamins from Amazon, £16.18.

12.30pm: My meeting is done and I’m proud of myself for facilitating a technical-heavy conversation with a lot of engineering jargon and acronyms. I’m finally finding my feet after six months of feeling a bit lost in this role.

1pm: Treat myself to an Itsu teriyaki chicken bowl, £7.99.

6.30pm: T and I are out to celebrate three years since getting engaged. We make this a tradition every year. We take the Tube to a new Italian place nearby.

9pm: The food is nice but we end up waiting about 30 minutes for starters. We have arancini balls, mac and cheese and calamari to start and for mains I have mushroom and truffle pappardelle and T has pork ragù. I pay for dinner, £72.

10.15pm: We walk halfway home before we are actually sweating a bit. I think we’ve done enough to balance out the carbs eaten. We take the Tube for two stops.

10.30pm: Browse on the usual online shopping apps (Vinted, ASOS and H&M) to see if there’s anything that catches my fancy.

11pm: Lights out after some peppermint tea, usual skincare routine and reading.

Total: £102.67

6.50am: The alarm startles me awake as I’m in the office today. I make my coffee, take a shower, do my makeup routine and get ready within 45 minutes. I didn’t realise I was that quick and I’m feeling smug!

9am: I park up at work. It takes me around an hour and 20 minutes to get in but I usually never realise as I have plenty of podcasts to get me through the journey. Today I listen to Crime Junkie, which should be my middle name as I’m proper into anything crime. Don’t side-eye me, it’s not weird.

11am: My morning meetings are done and I’m in need of a coffee fix. Our office canteens are subsidised so we get food and drink for a very reasonable price. I get a coconut flat white, £1.53.

12pm: £3.60 comes out for TfL travel from last night.

12.30pm: I grab a cauliflower, broccoli and crayfish salad and chocolate-covered almonds on my way home, £9.47 (the almonds cost more than the salad but I can’t resist chocolate orange almonds, yum). None of my team is in and my afternoon is back-to-back so I’d rather be at home if I’m not going to collaborate in the office.

5pm: I finish off all my meetings and have a lovely end-of-year review. I never know how I’m doing at work as I feel very much out of my comfort zone working in an engineering team but my manager reassures me that I’m actually going above and beyond in some of my objectives and generally doing really well, which is so nice to hear.

5.30pm: Quickly get ready for the gym for a kettlebell class.

7pm: After a sweaty sesh I get home, shower, then do a face mask from The Body Shop to try and dry up two little friends that have made an appearance on my face. It actually works!

8pm: I make a quick dinner consisting of coconut egg fried rice with chicken gyozas. It is delicious and curbs my craving for a takeaway.

10.30pm: Watch Ugly Betty all evening, snuggled up on the sofa. T is out with work and I miss him.

11pm: Drag myself to bed after brushing teeth and doing skincare routine.

Total: £14.60

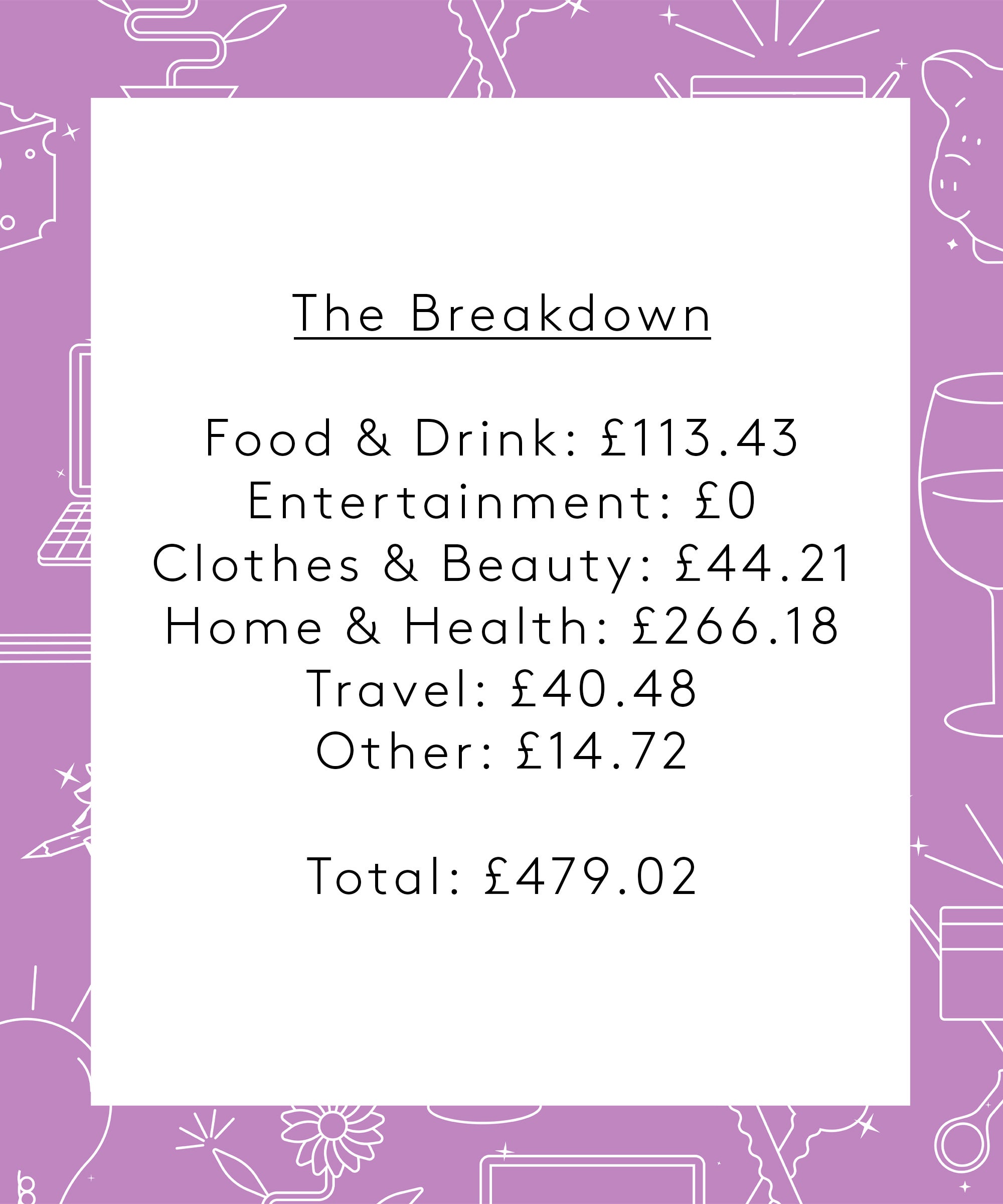

Food & Drink: £113.43

Entertainment: £0

Clothes & Beauty: £44.21

Home & Health: £266.18

Travel: £40.48

Other: £14.72

Total: £479.02

Conclusion

“This week was a little out of the ordinary as I was unwell. I probably would have spent more on clothes and beauty if I was feeling better as it is definitely something I spend my money on. If it wasn’t for our meal out I think we did well on food but we do love a takeaway or meal out to break up the routine. Going forward I’ll probably have to assess how I spend in regards to treatments like PRP.”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A Travel Operations Executive On 23k