This week: “I’m a 27-year-old mum of a feisty toddler, working part-time. I live in the southeast with my husband, baby and the dog. We find ourselves in a constant battle between ‘treat yourself’ and being sensible and paying off the credit card and building savings. We have a healthy amount of equity in our house at the moment but that will be wiped out this year when we remortgage and (hopefully) pay back the Help to Buy equity loan we took out when purchasing our house. On paper, our household income seems great (£60k plus bonuses, around £75k if I was FTE) but life is just so expensive that we have to cut back on a lot of luxuries. We haven’t been abroad since the world reopened, we rarely have proper date nights, I do my own nails and I’ve recently started buying/selling clothes on Vinted. I don’t want to moan too much because we are in a really good position and I am well aware that many people are struggling at the moment. We had such high disposable incomes pre-baby but we chose to start a family and have those responsibilities so we have to suck it up.”

Occupation: Business management assistant

Industry: Property consultancy

Age: 27

Location: Southeast

Salary: £30k but pro-rata to my part-time hours so actually £16k.

Paycheque amount: £1,194

Number of housemates: Two: my husband and our toddler. Plus the dog!

Pronouns: She/her

Monthly Expenses

Housing costs: £716 mortgage. This is paid from our joint account.

Loan payments: Personal loan is £116 per month.

Savings? About £2k (joint).

Pension? There’s about £18k in one pension pot from my old job. In my current job I pay 3% (I’d like it to be more but I’m only part-time and kids are expensive).

Utilities: £130 electric, £13 water, £178 council tax, £75 TV and broadband package, £709 for two cars on finance, £35 private road management fee. All of this comes out of our joint account, which I pay £615 into a month and my partner covers the remaining £2k.

All other monthly payments: My phone is £32. Childcare is around £350 a month (paid from joint account). Subscriptions: £10.99 Apple Music, £4 online Pilates membership.

Did you participate in any form of higher education? If yes, how did you pay for it?

No, I didn’t. I didn’t even get any A-levels!

Growing up, what kind of conversations did you have about money?

We didn’t discuss money at all as it was quite a hush subject. Once I turned 18 I was encouraged to get a credit card (which my parents used) and I also took out finance deals for materialistic things. I really regret this now as I had almost £10k worth of debt at a really young age.

If you have, when did you move out of your parents’/guardians’ house?

I was around 21. We moved into my in-laws’ and then purchased our house around one and a half/two years later.

At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?

Around 19, when I took on my first car finance. I then moved out at 21 and was fully responsible for myself. I don’t have a safety net as such, although my partner’s salary covers the bills so there’s the security in knowing that if anything happens to my job, at least the bills are paid.

What was your first job and why did you get it?

My first job was in a call centre. I got it because they employed kids straight from school to pay them minimum wage. I lasted two weeks.

Do you worry about money now?

I do worry about money. Despite us both being in good positions with great career prospects and the potential to earn more money, I still worry. I’m definitely the voice of reason with money now. Every big purchase is planned and thought out, I don’t even pay to get my car valeted unless it’s filthy and beyond cleaning myself.

Do you or have you ever received passive or inherited income?

Kind of. My grandparents loaned us a small amount toward our house deposit. Once we’d paid back a fair chunk they told me the rest would be a gift, as they saw my main priority was to pay them back and they appreciated that. It meant that we could replace our secondhand washing machine!

8.30am: I’m not at my usual office today. The company will reimburse me for parking and mileage.

8.45am: Seeing as I’m not in the normal office with unlimited Nespresso pods, I pop to Costa. I get a skinny caramel latte and a bottle of water, which doesn’t cost much as I have some money left on a gift voucher, £2.25.

12pm: I try to make lunch at home and bring it when I can but some evenings I get lazy. I think about skipping lunch and just grabbing a snack when I get home but today has been so tech-heavy, I have a headache and I’m hangry.

12.15pm: I pop down to Tesco Express and pick up a meal deal: a trusty chicken salad sandwich, light Ribena and a little chocolate bar for later, £3.40. I scoff my sandwich behind my laptop screen as I’m in clear view of the customers walking in. I then amaze everyone in the office as I suddenly become a much happier version of myself once I’ve eaten.

6.30pm: Get in from work and as I’m bathing the baby, my husband tells me that he’s playing six-a-side football tonight and will be leaving soon. I pay for his car parking on one of the parking apps before he leaves as he’s a bit of a technophobe.

7.30pm: I realise there’s just enough wine left in the fridge for a small glass so I forget about Pilates for tonight and pour myself a little rosé instead. Cook dinner and leave his plate for him for when he gets back.

Total: £5.65

10am: I’m visiting another office today so more parking costs. There’s a new manager in this office who I haven’t met properly yet so I’m excited to meet her.

1pm: Pop into Sainsbury’s on my way home (will be WFH for the rest of the day) to grab milk and another punnet of strawberries for the toddler, £4.03. This will come out of our food budget, which is set aside at the start of the month. I probably spend £10-£15 a month on fruit as she will always ask for some “bees” (strawberries) or a banana for a snack.

7pm: It’s a family member’s birthday so we have some of my partner’s family come over to our house to put baby to bed while we go out for dinner.

9pm: Our share of dinner comes to £85 but my partner pays. He usually pays for meals out and I get the odd takeaway or a little Nando’s etc.

Total: £4.03

9am: I pop into the corner shop near the office and grab a bottle of water and a pint of milk, £1.80. The milk should be reimbursed as it’s an office expense but I stupidly forget to ask for a receipt as the phone rings while I’m in the shop and I get distracted.

12pm: Walk to Waitrose (I know, very snooty) on my lunch break. I grab my favourite peri chicken wrap, £3.50. I’m more than capable of making myself lunch the night before but as I do the childcare drop-off in the morning, I’m usually juggling so many bags that half the time I forget it. I have a can of Diet Coke in the fridge that is left over from last week so I’ve convinced myself I’ve saved money. I also buy some bin liners for the office as the cleaner never tells us when we’re low, and some more coffee pods, which will be reimbursed.

5pm: I finish work, head home and do the usual bedtime routine.

7.30pm: Cook our dinner and head off to bed way before 9pm. We’re experiencing the dreaded 12-18 month sleep regression and it has hit us like a train so I’m snoozing where I can.

Total: £5.30

11am: I was up early this morning with the toddler. We have breakfast and then I potter around, catching up on housework while she naps (over two hours!).

12pm: We take the dog for a walk, which is actually quite stressful as the toddler’s suddenly decided she hates her pushchair.

12.20pm: I give the toddler her lunch at home while I have a coffee, then we go out for the afternoon.

1.30pm: Stop at a cashpoint to get cash out. We’re trying a new playgroup today and they give the option of paying £5 per session in cash as a trial before paying upfront for the term.

2pm: We end up getting there a bit early so I grab myself a sausage roll, bottle of water and a banana for the toddler, £5. I only get to eat a few bites of my sausage roll as the toddler decides she fancies a second lunch.

3pm: There’s a supermarket near the playgroup, which is handy as we’re out of pull-ups. I don’t usually shop in Morrisons so I get a small pack of own-brand pull-ups for £2.50.

3.15pm: Toddler spots her favourite snacks and refuses to leave without them, although we have lots of the same thing at home. Another £2.50 just to keep the peace.

4pm: Get home and put dinner in the slow cooker. We then sit and watch Bluey (elite kids TV) until dad comes home from work.

5.30pm: It’s nice to eat dinner together as she usually eats at the childminder’s on my work days. Afterwards we start the usual bedtime routine.

7pm: She’s a bit clingier tonight as she’s spent all day with me, and spends 30 minutes crying for me until she eventually falls asleep.

Total: £15

8.15am: I’m on a training course today and I suddenly realise that I’ve left all my stationery in the office, 45 minutes away.

8.30am: Quick dash to Tesco to buy a notebook, pens, a bottle of water and a Graze lemon flapjack. I can get away with claiming this on expenses, which is handy.

9am: As today isn’t a usual work day for me, I can also submit for overtime, which will be handy next payday!

12pm: All the meals today are covered as it’s a corporate event so it saves me needing to buy another meal deal.

5.30pm: I go straight home after the event, battle the traffic and deal with the usual bedtime dramas.

8pm: My partner is late home due to a pretty crappy work day but he does come back with my favourite rosé and some chocolate.

10pm: Sleep.

Total: £0

9am: I pop out to Sainsbury’s to do the food shop while the toddler is napping. (Husband is at home, I haven’t abandoned my child!) We have a quibble over who gets to do the shop, as it’s the only hour of peace we have at the weekend.

10am: The shop should come to £60.53 but I use £30 of Nectar points to keep the costs down. I know we could probably get the same shop cheaper at Aldi or Lidl but we are slightly snobby and I can’t always get everything we need in the local Aldi. It’s easier just to get it all in one place, and I find the fruit and veg at Sainsbury’s doesn’t go off as quickly. We are also trying to make an effort to eat more veggie meals to keep costs down. Today’s food shop includes all dinners for seven days, snacks, Diet Cokes (a necessity) and a little bit of alcohol, £30.53.

1pm: My other half is at football so we wrap up and head out on a dog walk. It isn’t as disastrous as the other day, although the dog avoids every puddle and clearly thinks he’s a princess, refusing to get wet.

2pm: Get back, play blocks, dance to Taylor Swift (my baby is a Swiftie) and chill until dinnertime.

5.30pm: Once my partner is home we have dinner as a family (we try to do this as much as possible) and then it’s bedtime.

8pm: Once baby is in bed we have a glass of wine and finally get to watch Glass Onion.

Total: £30.53

9am: We get up and out once the toddler has her breakfast. We head to our local park for a family dog walk. As it’s still quite early, we don’t take the pushchair and let her run riot. It’s so nice to see. We’re usually in such a hurry, the pushchair is the easiest option, but as it’s a Sunday and we don’t have much to do today, we let her explore and figure things out for herself.

10am: Toddler sees a pigeon and calls it a duck (close enough) and runs through lots of puddles. I pay for parking and my husband gets us coffees, £1.

10.30am: We pop into Tesco to buy a tiger baton to have with our dinner (sausage casserole). I also forgot my husband’s favourite crisps when I did the food shop, £2.

12pm: We head home, ready to have lunch, and count down the minutes until baby’s nap time.

2pm: We like to spend Sundays trying to get the house organised. We do the ironing so we’re ready for the week back at work and also ready for the childminder.

5pm: Have family dinner before bedtime routine and an early night for us.

Total: £3

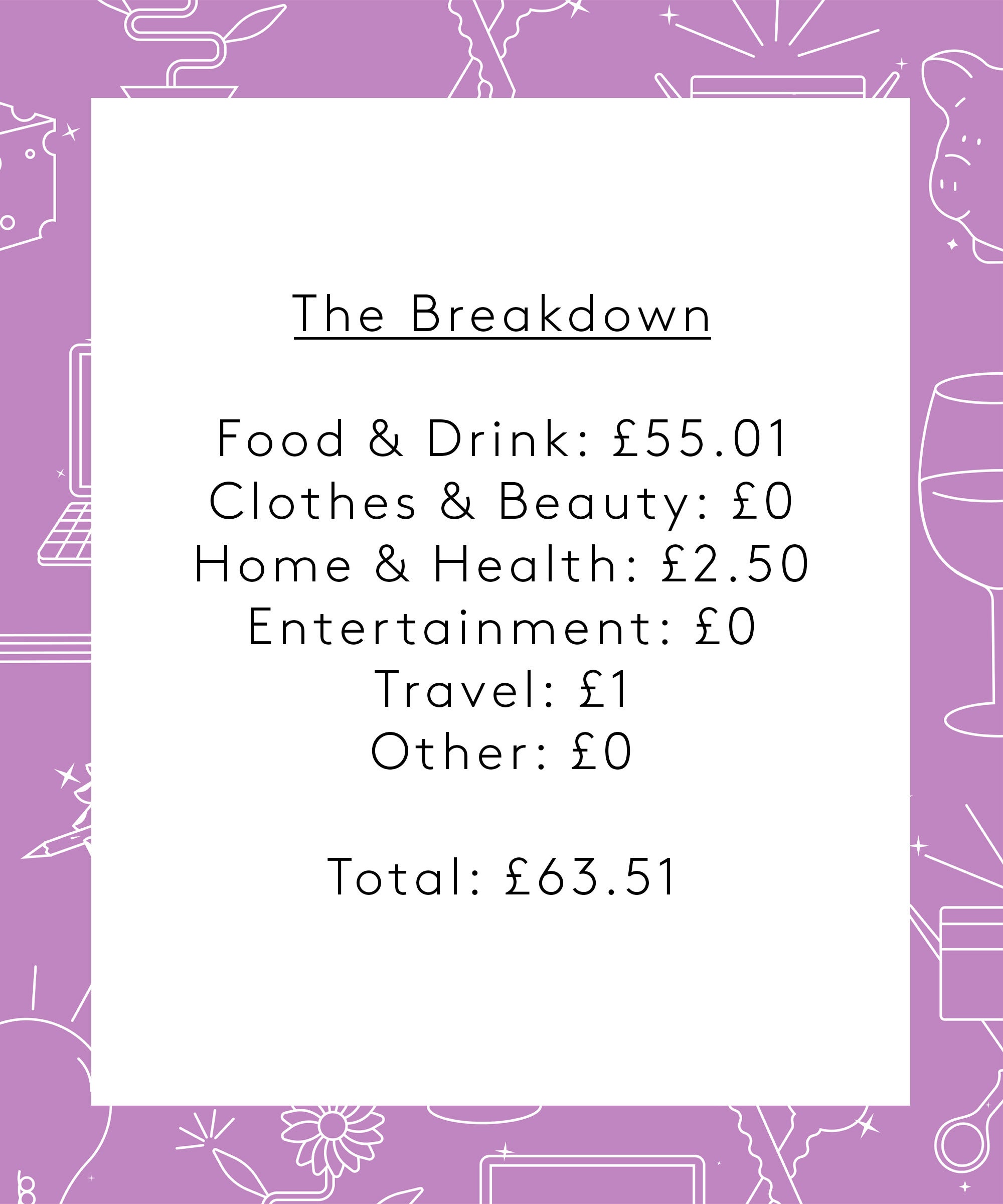

Food & Drink: £55.01

Clothes & Beauty: £0

Home & Health: £2.50

Entertainment: £5

Travel: £1

Other: £0

Total: £63.51

Conclusion

“This week was actually quite boring, looking back on it, but it is a pretty standard week. Going back through to see what I spent was interesting and I definitely do have a habit of buying lunches when I’m capable of making food at home (and probably have the bits to make it). This is definitely something I’m going to work on. Other than the odd coffee out, I don’t really buy anything for myself so I guess I should start doing that.”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A Boarding Houseparent On 23k