This week: “I’m a 24 year old living in Edinburgh. I moved here for university and have stayed ever since. I currently live with my partner (J); we have been living together for a couple of years now. He works at a civil engineering firm, which he loves. I’m less happy in my current role — moving to finance was a big change from what I studied at university and I’m not sure it is for me long term. I have never really had the opportunity to save, and I’m really enjoying it at the moment. I would like to stay in my current role in finance until I am able to buy a flat with my partner, which will hopefully be in the next year or two. After this I will probably switch to a less lucrative role as I will be in a more stable position.”

Occupation: Analyst

Industry: Banking

Age: 24

Location: Edinburgh

Salary: £55,000

Paycheque amount: £3,333

Number of housemates: One – my partner, J

Pronouns: She/her

Monthly Expenses

Housing costs: My share of the rent is £600.

Loan payments: £119 (student loans)

Savings?: I currently have £8,500 in savings, which is going towards a deposit for a house.

Pension?: I currently put £243 into my pension every month, my employer matches 50% of this.

Utilities: £164 for my share of gas, electric and internet.

All other monthly payments: £100 gym membership; £15 dental; £12 phone bill

Subscriptions: £10.99 Spotify

Did you participate in any form of higher education? If yes, how did you pay for it? I went to university; it was always expected for me to go. I got free higher education as I am from Scotland, but I took out student loans to help with living costs. My parents also gave me £250 a month to help with living costs, which I am very grateful for.

Growing up, what kind of conversations did you have about money?

I was never really educated about finances. I have never been shown how to save so I had to figure it out myself! I know money was always a massive issue for my family growing up and there was always stress surrounding it (or lack thereof).

If you have, when did you move out of your parents’/guardians’ house?

I moved out of my parents’ house when I went to university at 18.

At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?

I became financially responsible after I finished my university degree. I earn more than either of my parents now, so don’t need to be supported anymore. It feels nice not to be a burden and to be in charge of my own finances now. If something happened and I lost my job I know my partner would step in to help me out.

What was your first job and why did you get it?

I got my first job the summer after high school finished, before I went away to university. I wanted to save up for a laptop and a fresher’s wristband (which is not worth getting, haha).

Do you worry about money now?

I still worry about money all of the time. I think that is because of how I grew up, it’s not something that will change for me anytime soon. I do know though that I currently make enough to support myself and help myself through any rough patches I may go through.

Do you or have you ever received passive or inherited income?

Apart from the £250 a month while at university, I have not been given anything!

7 a.m. — I grab a coffee on my way to work. I have a Caffè Nero discount from my phone provider, so it came to £1. I need to be in work around 7:15 a.m., which I really struggle with. £1

12.30 p.m. — On my lunch break, I stretch my legs and buy a gift for my partner for our anniversary, which is coming up soon. Feel good being prepared for once and not scrambling to get something last minute. I’ve brought in a packed lunch: a very sad bagel which I quickly made before going to work. I really hate buying food outside for lunch. I feel like it’s such a waste of money and is never that nice. £44

5.30 p.m. — I manage to finish work and walk home. I really value living in the city centre where I can get home in 25 minutes. On the way home I pop into Tesco to get garlic bread to go with dinner (I bought the rest of the dinner last week). To be a bit money savvy I do a lot of meal prep. I find that when I don’t meal prep, I end up spending way too much money on food. £2.90

7.30 p.m. — After mindlessly scrolling on TikTok for an hour my partner J comes home. We do a few chores and put our meal-prepped food in the oven. We then spend the evening watching This Is Us and building an IKEA bookshelf that takes us far too long to do.

10 p.m. — Head to bed; I like a lot of sleep, especially considering how early I have to wake up.

Total: £47.90

7 a.m. — I walk into work again earlier than I would have liked. No discounts this time, so I reluctantly splurge on my morning caffeine fix. £4.25

2 p.m. — I hit that midday wall like a tonne of bricks, so naturally, I cave and grab another cup of coffee. Another £4.25 down the drain, but hey, at least it keeps me going for about another half an hour. I again brought a packed lunch from home. However, I did not bring a sad bagel this time but homemade pasta salad (which I will be having for the rest of the week). £4.25

5.30 p.m. — Finally free from work, I saunter home, enjoying the lack of rain for once. I pop into a local bargain store to buy a sieve, as I want to get back on the banana bread-making train that I started in lockdown. £2.99

5.45 p.m. — J messages me on the way home to ask if I want to go for a drink. No banana bread will be made tonight! We pop into the local bar across the road from our flat and spend a good portion of the night getting drinks, which eventually turns into dinner. J takes care of the bill, so I don’t spend anything.

11.30 p.m. — We get back home and crash into bed, embracing the sweet embrace of sleep. Resting up for another early wake-up call tomorrow and praying for no hangover (they tend to come very easily to me these days).

Total: £11.49

7.30 a.m. — I work from home today, which means one thing: half an hour extra in bed! I quickly make my caffeine fix at home, meaning it is free (and tasted better in my opinion), before settling down for work.

11 a.m. — J is working from home with me so at 11 a.m. we take a break and stroll over to a coffee shop near the house. I buy the coffees and we both resist the urge to get a sweet treat. We take the long way home to spend as long as we could outside, and away from office screens. £6.75

1.30 p.m. — For lunch we eat the homemade pasta salad together, which does not taste as good as it did the day before. (Maybe even worse than Monday’s sad bagel) — but at least it doesn’t cost us anything else.

6 p.m. — We forgot to take the meal-prepped food out of the freezer, and we would have been waiting for hours for it to defrost, so I run over to the shops after work and buy dinner for that evening and a few essentials, which J and I cook together. £14

7.30 p.m. — After dinner both J and I are exhausted. We both work pretty hard and by mid week we are normally crawling to the weekend. We head to bed around 7.30 p.m. but spend more time than we would care to admit on TikTok. We clearly live very exciting lives! We both wish we could slow down a little and have a bit more free time — when we are so exhausted we can’t properly enjoy it.

Total: £20.75

6 a.m. — I had to get to work very early today so take an Uber (which I don’t normally do) at 6 a.m., but it’s too dark to walk. I’m in work by 6.15 a.m. I brought a coffee in from home as no cafés were open at that hour. I really hate being the first in the building, but work has got to be done! £4.67

11 a.m. — I’m absolutely exhausted, so I nip out for another coffee and to stretch my legs, which sets me back £5.95. I splurge on a nicer coffee as I 100% deserve it for being in work so early. £5.95

1.30 p.m. — I didn’t bring a packed lunch today so have to buy food for lunch! This was 100% on purpose, hahaha. I deserve better than three-day-old pasta salad. I get a meal deal from Tesco. I don’t really have anywhere to sit down to eat lunch at work apart from my desk — which I really don’t like doing — so I grab a coffee from Starbucks and hide in the back of the top floor and secretly eat the meal deal as well. £8.45

6 p.m. — I’ve run out of pasta, which I need for dinner tonight, so I pick some up on my way home from work. The rest of the dish was already meal prepped so my partner and I make dinner pretty quickly. £1.43

7.30 p.m. — Sadly, it’s time to get back to work so I make another coffee and do a couple more hours of work until around 10.30 p.m. before heading to bed and crashing out almost instantly.

Total: £20.50

7 a.m. — It’s Friday, which means I can again work from home, which I am very happy about. I quickly pop out for some milk and other essentials before settling down for a day of work. £5.64

1 p.m. — After getting up about three times in the morning to make coffee, it’s time for lunch. J very kindly buys us poke bowls and we watched an episode of Love Is Blind (with much protest from him, hehe).

6 p.m. — After work we take a return train to see some family and stay overnight with them. We buy return tickets, which I pay for. We really value spending time with family and friends over the weekend, as during the week we don’t have that much time to do so. It feels like I am living for the weekend at the present moment which is not a good way to be. I’m thinking about changing jobs as I just get so exhausted from the current work I do and don’t feel that fulfilled. £26.40

8 p.m. — My parents make a chicken casserole for dinner for us, and we sit up playing boardgames and drinking wine for a while. I don’t particularly like games, but my dad does, so I do that to make him happy. It’s nice to chat to them and catch up all evening.

1 a.m. — We head to bed pretty late for me. I’m 100% not a night owl, hahaha.

Total: £32.04

9 a.m. — I manage to sleep in until 9 a.m. which is a luxury for me these days. No one else was up, including J (he has the ability to sleep until 2 p.m., which both amazes and horrifies me), so I sneak out to a couple of the local shops. I buy groceries for lunch so I can make something special for my parents. I forget Scottish laws mean I’m not going to be able to buy a bottle of wine until 10 a.m., so I wander around a couple other shops until I can grab a bottle of red. £21

11 a.m. — I start making lunch for the family, with much backseat cooking instructions from my mum. I’m an absolutely rubbish cook — to the point where once every couple months I set fire to things — but I think my mac ‘n’ cheese doesn’t turn out too badly, and the wine is also quite nice, if I do say so myself.

3 p.m. — J and I hop back on the train home. We bought return tickets on our way here, so it doesn’t cost us anything else.

7 p.m. — Later in the evening we walk over to a friend’s house for a kind of triple date, I guess you could call it. We bring some wine and snacks along with us. It’s great spending the evening sitting and chatting nonsense. £19

2 a.m. — Pretty drunk, we call an Uber home. I won’t be able to escape a hangover this time. £7.50

Total: £47.50

10 a.m. — As I suspected, I do not escape the hangover. I crawl out of bed, pop over to the local bakery and buy coffee and pastries for J and me. I go back to bed after this and lay in bed for a couple more hours… Maybe scrolling on TikTok. Luckily, the hangover is gone by midday, so I don’t waste the rest of my weekend! £12.98

2 p.m. — Later in the day, J and I buy groceries for the week. We then spend the next couple of hours meal prepping for the week. We always find this helps us spend less money throughout the week. I think prepping for the week makes my week seem more structured, which I also like. £30.50

6 p.m. — I decide to do something nice for J and take him out for dinner. We go to a cheese and wine bar that we love that’s not too far from the house. We spend a couple of hours chatting and planning our next holiday (hopefully somewhere in South East Asia), before heading home for an early night. £45

9 p.m. — By 9 p.m. I’m prepped and ready for bed. I read a little, which I never ever do — but start the new week off as you mean to continue, I guess. I psyche myself up to get ready for the next week of work, while planning the trip my partner and I spoke about at dinner in my head.

Total: £88.48

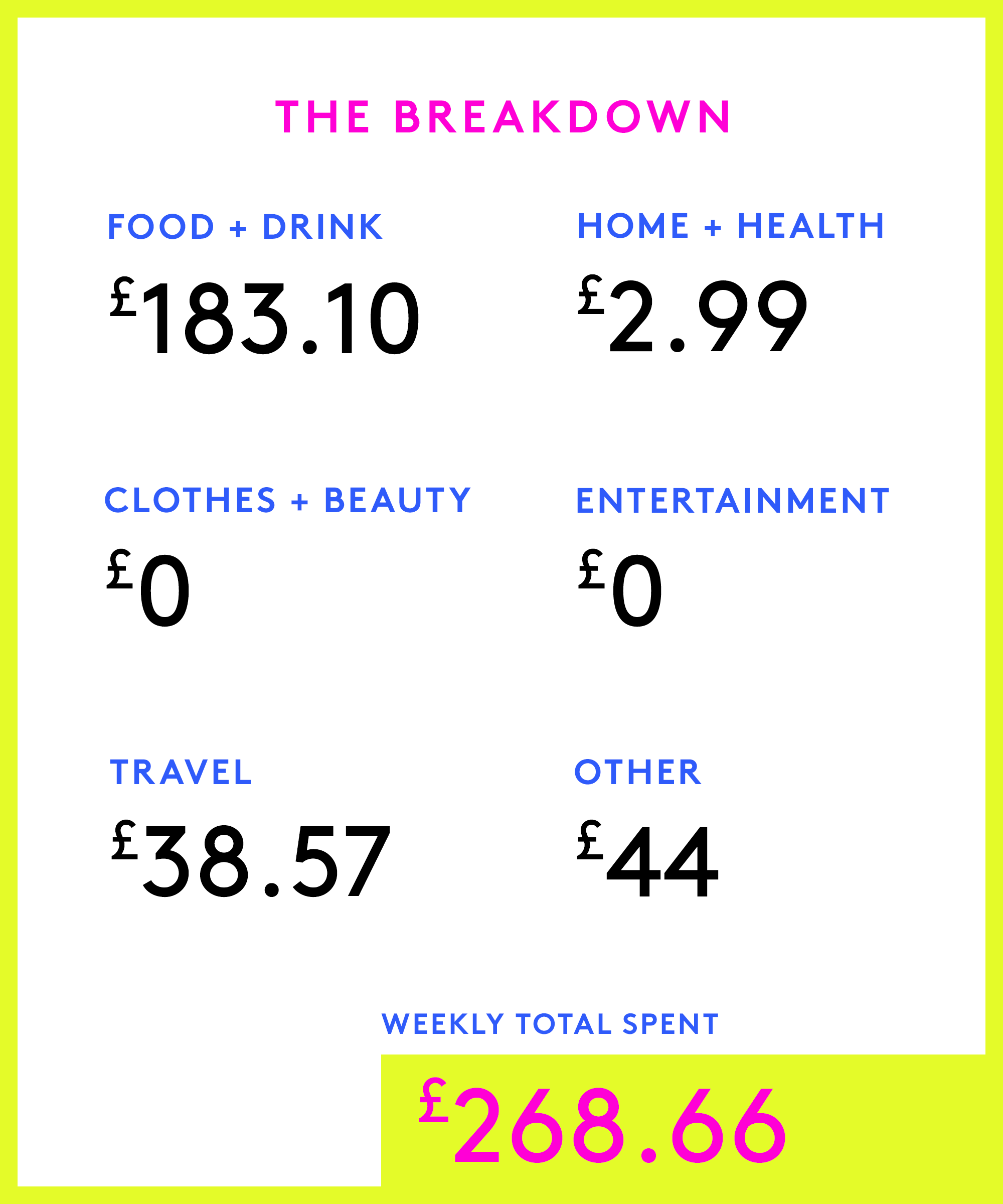

Food & Drink: £183.10

Clothes & Beauty: £0

Home & Health: £2.99

Entertainment: £0

Travel: £38.57

Other: £44

Total: £268.66

Conclusion

“I think I noticed a lot of my money goes on coffee, so in the future I will try to make it at home! But overall, I really don’t think I spend that much money in an average week. One thing I did notice is that I really need a new job, haha. Maybe having a good salary for my age isn’t worth it!”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A Database Assistant On £28,000