Last September, despite the ongoing coronavirus pandemic, students were encouraged to travel to university and stay in halls or rented accommodation – even as lectures and seminars moved online. As a result, thousands of students across the country have been locked down, isolated and denied the university experience they’ve paid for.

As the pandemic continues to threaten jobs, wages and career progression, the vast debt students have racked up can feel impossible to pay off.

Ahead, we speak to graduates across the UK about the amount they owe, how much they pay each month and what they think about student debt.

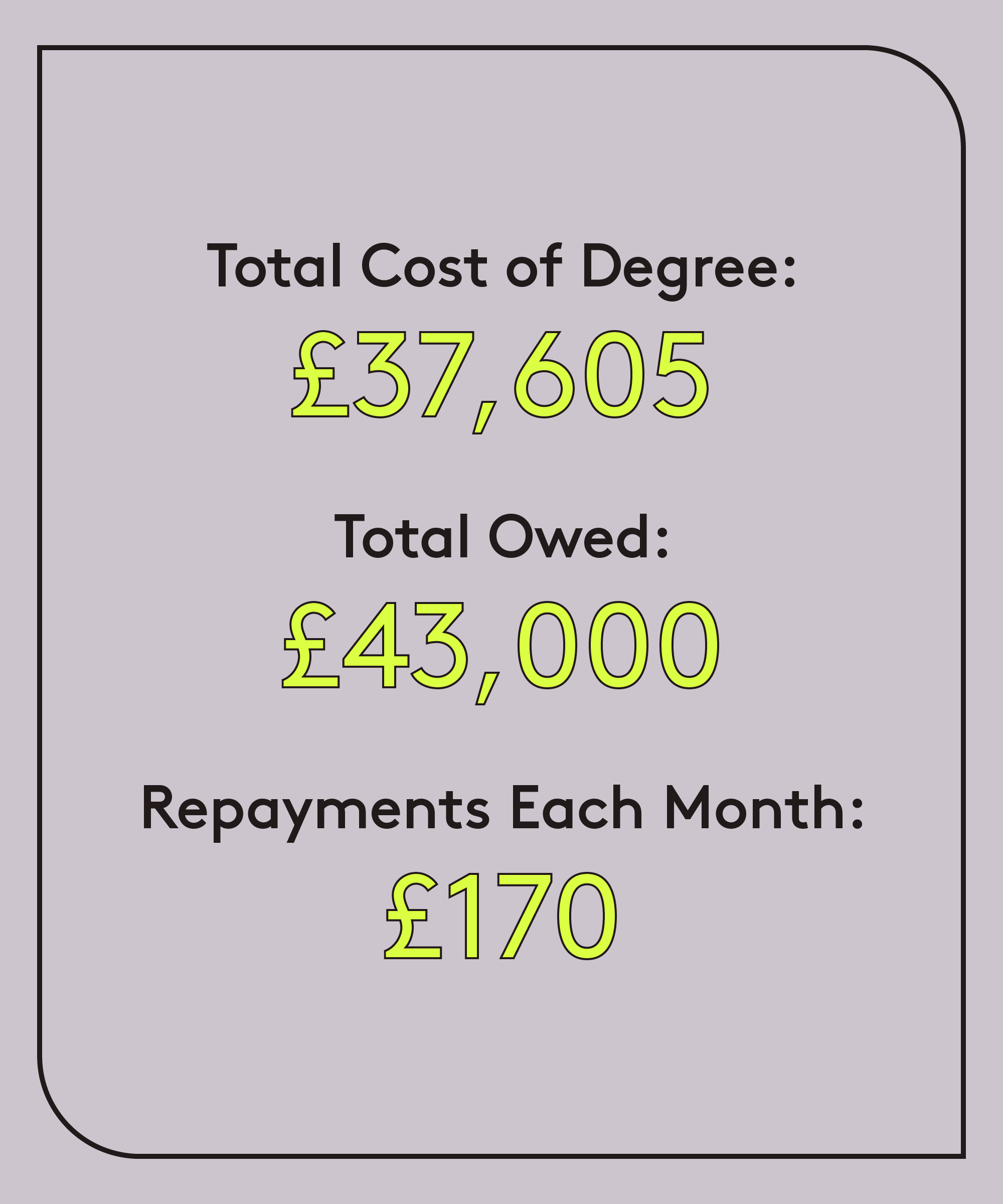

University: University of Birmingham (2012-2015)

Degree: Chemistry

Occupation: Chartered accountant

Total cost of degree: £37,605

Total owed: £43,000

Repayments each month: £170

Plan: 2

“Any time I get the yearly statement through for my outstanding student loan, I am always shocked. I feel like it goes up every year and I cannot make a dent in the amount, despite working full-time in a finance role since leaving uni. It can be disheartening speaking to others on Plan 1 (£3k) who manage to reduce their balance and have some sort of end in sight, knowing this is likely not going to be the case for me.

“I really don’t think I will ever be able to pay it off so I’m trying to view it more as a ‘graduate tax’ than a loan and will just celebrate the day it is written off when I am 51!

“I really feel for students right now, they are being completely robbed — at least paying £9k per year I had the full uni experience to go along with it.”

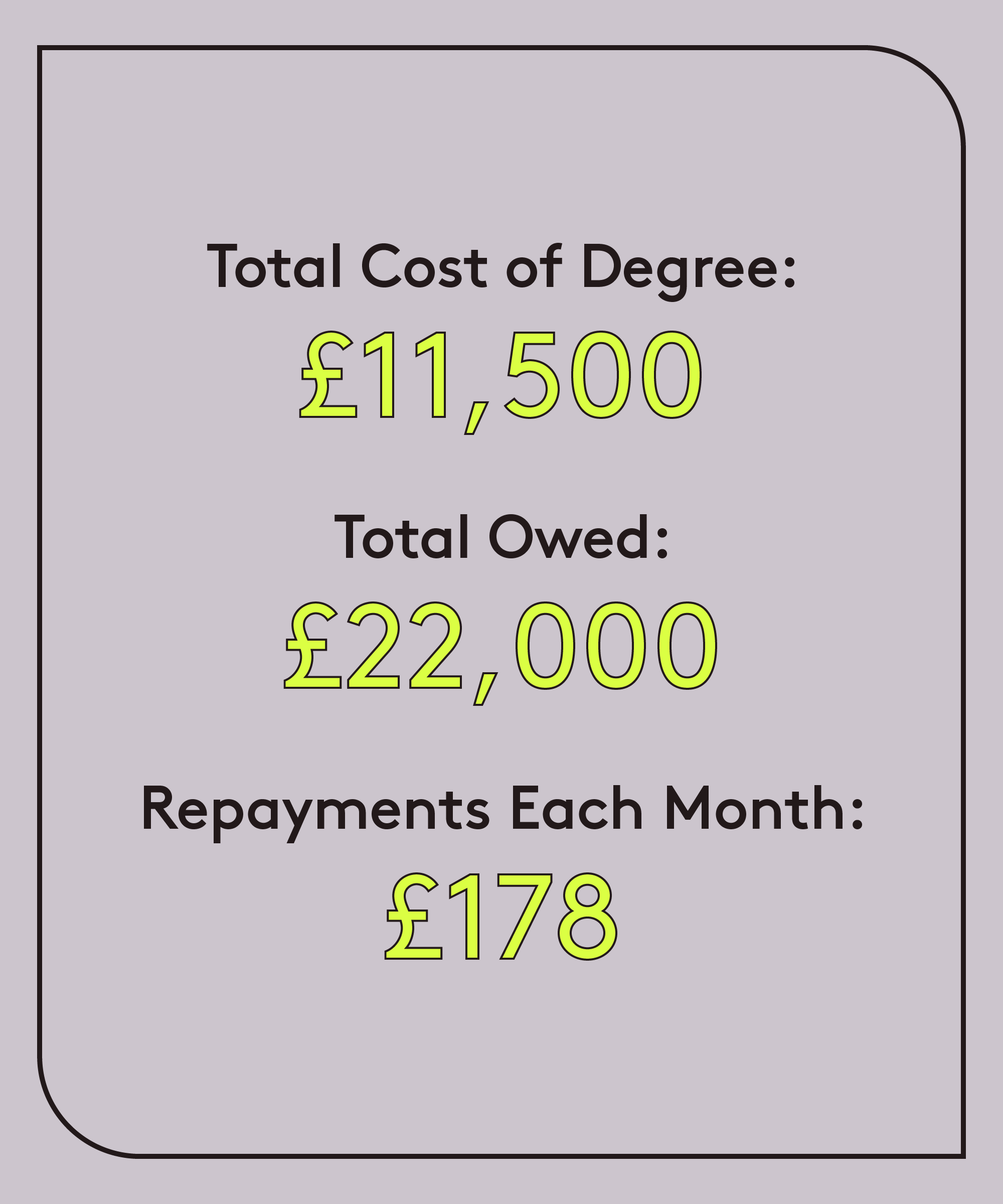

University: University of Hertfordshire (2010-2013)

Degree: Law

Occupation: Compliance officer, finance

Total cost of degree: £11,500

Total owed: £22,000

Repayments each month: £178

Plan: 1

“I think that student finance enables students to attend university and without this option it wouldn’t be possible. Unfortunately, I found it wasn’t clear how it would affect my pay when I started working. Most months I don’t notice my student finance repayment deductions from my wages as it is removed by my employer. The shock for me came when receiving an annual bonus: my student finance payments increased quite substantially and I certainly wasn’t aware this would happen — nor were most others in my position at the time.

“When I took my student finance out, it was advertised as an ‘interest-free loan’ which isn’t the case. The loan is only interest-free while studying. It was quite a shock when my first annual statement came through and I had only reduced the loan by about £200. I still have around £12,000 to pay off but I was quite lucky that I went to university when it was cheaper and I dread to think how much the waves of students with higher fees will be paying in interest. It is unlikely many of them will ever pay their loans off.”

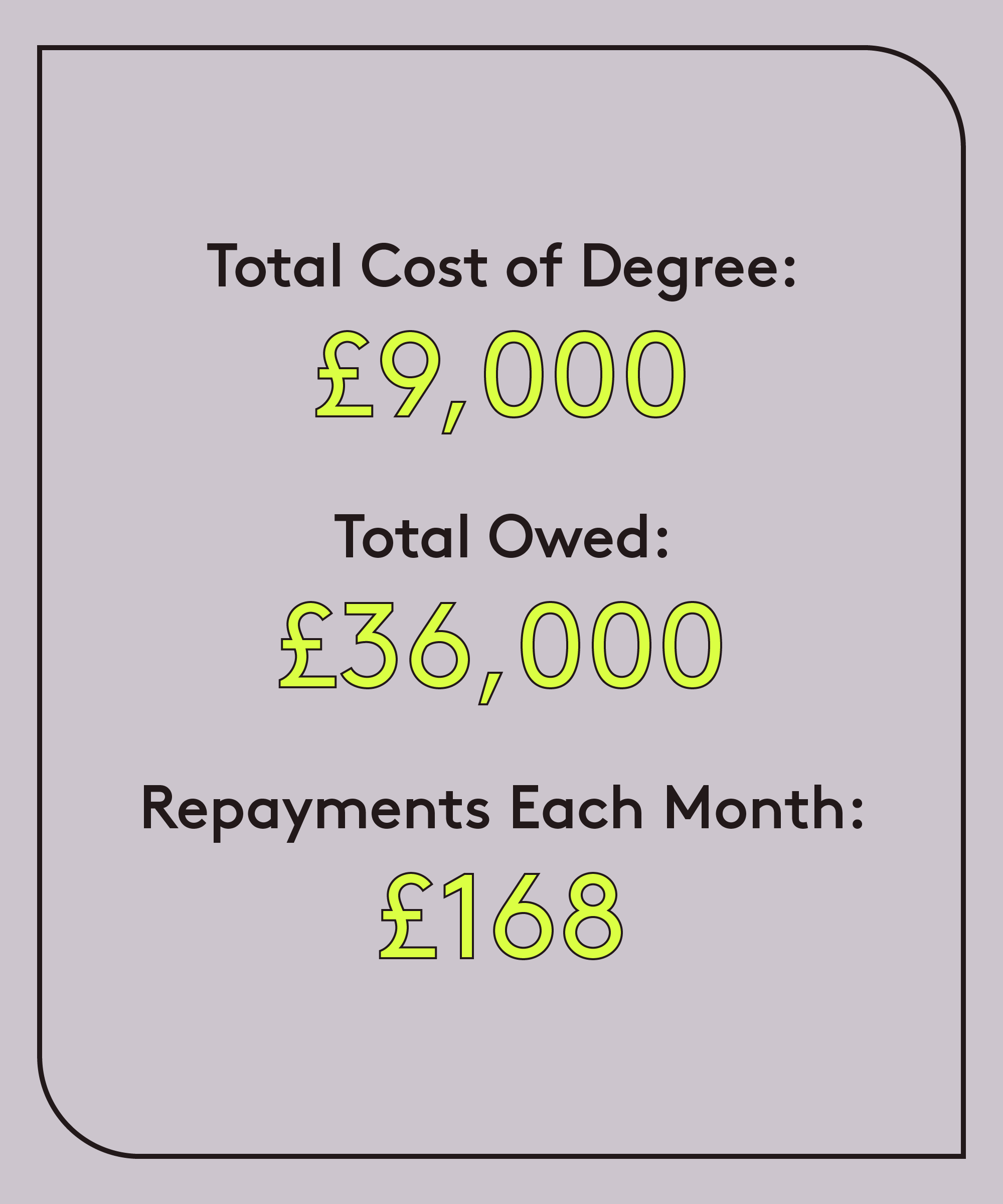

University: Goldsmiths (2009-2010) then London College of Communication (2010-2013)

Degree: Media and communications

Occupation: Content creator

Total cost of degree: £9,000

Total owed: £36,000

Repayments each month: £168

Plan: 1 (since 2009)

“My attitude has relaxed a lot more. I graduated in 2013 and employment wasn’t swift. I worked at a football stadium from 2007-2012 and it was about £250 a month after receiving all the training I needed. I then worked in a content role in 2015 and incurred interest on my loan repayment.

“I was in my bedroom a few months ago and found an old SLC (Student Loans Company) letter and can you believe I actually owed more years after university than when I graduated? I owed £33,716.66. I need to sit down. I need to lie down. I started uni in 2009. I’ve only repaid £3k in that time. This girl is shook and tired.”

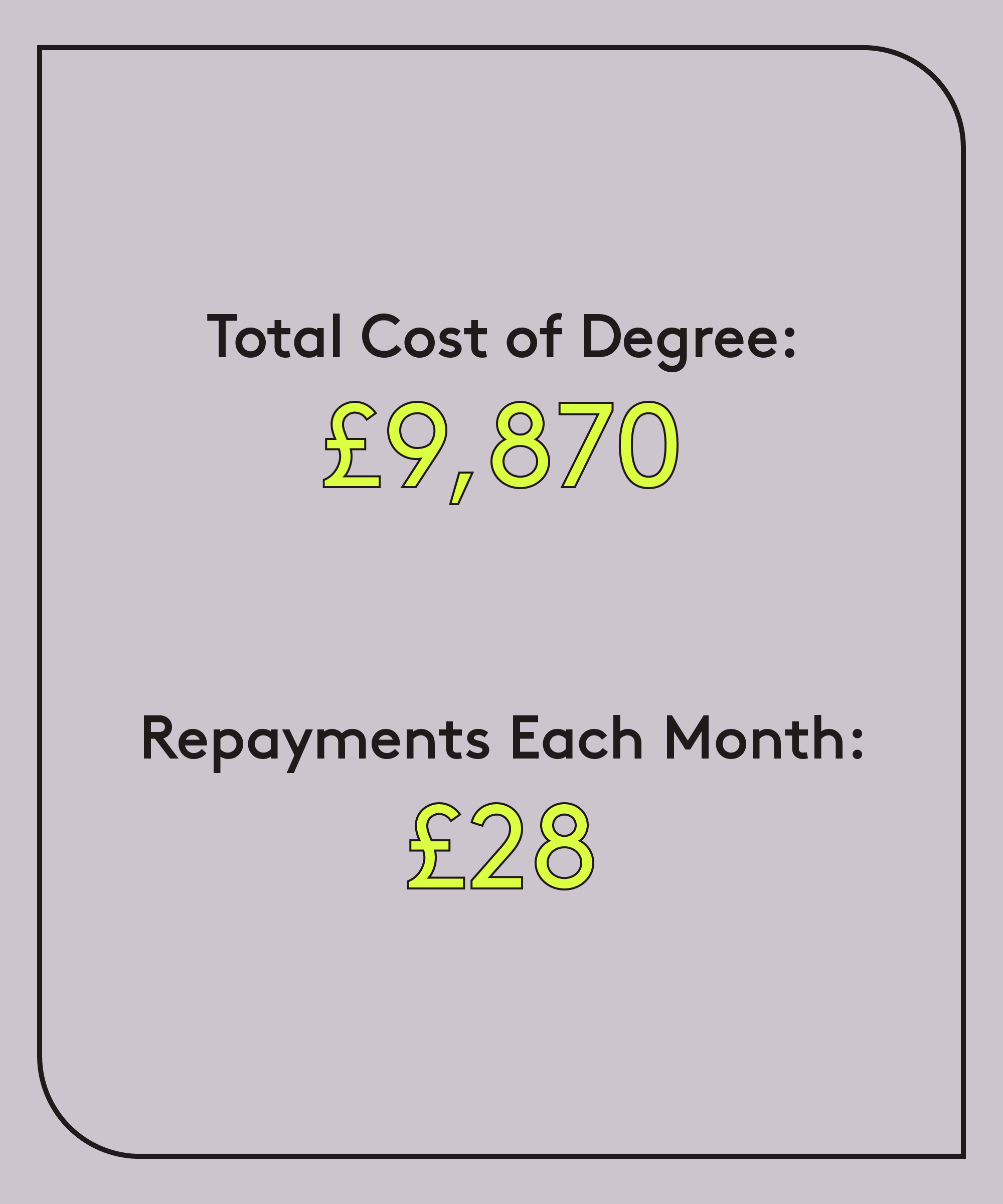

University: University of Liverpool (2011-2014) and Sussex University (2015-2017)

Degree: Philosophy (then law)

Occupation: Lawyer

Total cost of degree: £9,870

Total owed: £21,662.35

Repayments each month: £28

Plan: 1

“I really hated studying this degree. I felt like the tutors really did not care and offered little support. To think I paid all that money for a terrible experience (which led me to do a whole other degree after). It was clear the undergrads were there to fund the uni and its research, rather than help and support us.

“In an ideal situation, university would be free for everyone. While I believe anyone can get a student loan, we cannot ignore the fact that for some, they absolutely cannot justify acquiring this debt. Being in an industry that is rightly criticised for its mobility issues, you can’t help but question whether things would be different if we abolished fees altogether.”

University: London Metropolitan University (2011-2014)

Degree: BA Journalism

Occupation: Assistant PR manager

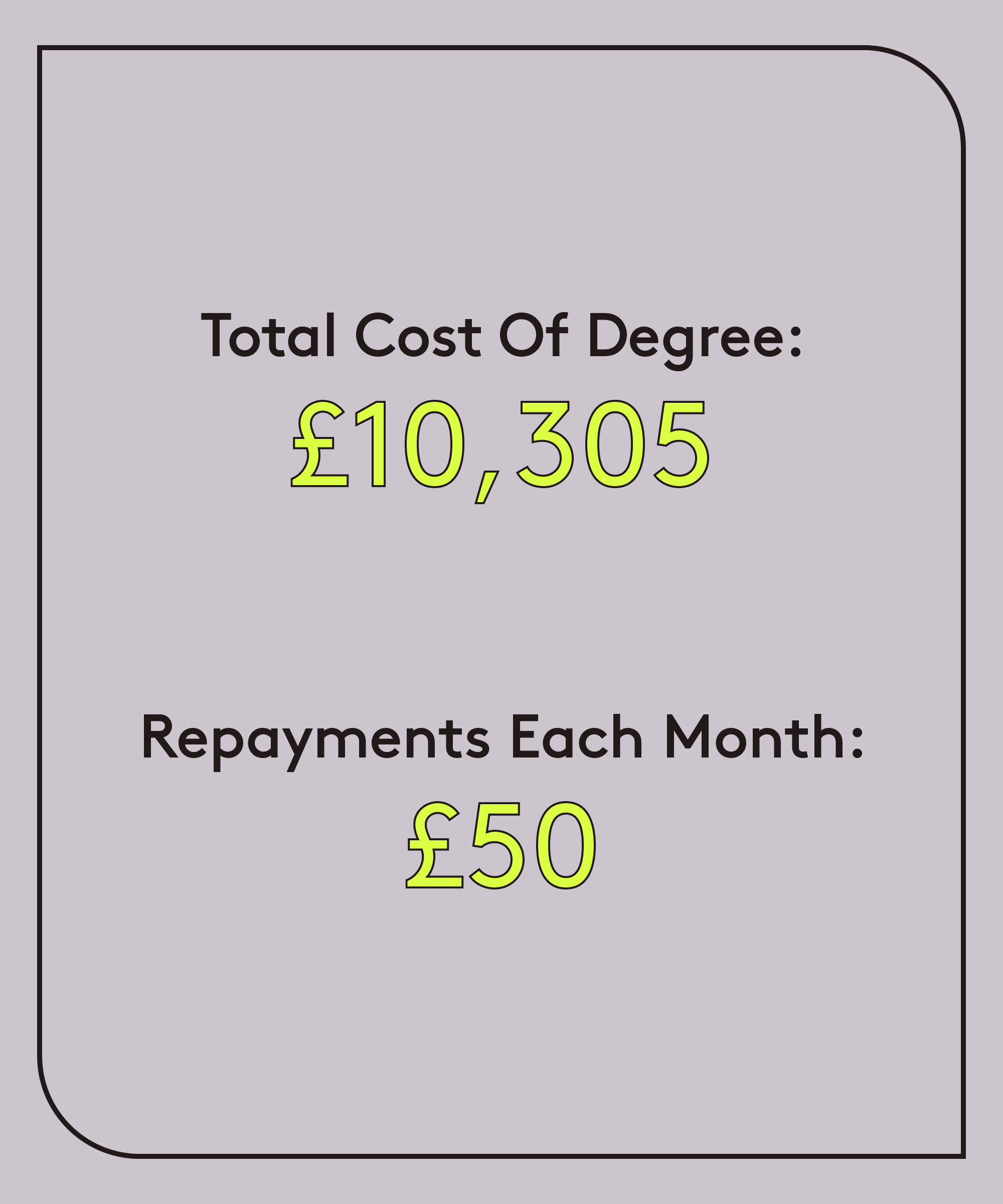

Total cost of degree: £10,305

Total owed: £19,204.93

Repayments each month: £50

Plan: 1

“I don’t mind paying off my student loan because it feels quite like the ‘normal’ thing for young people, plus I know all of my friends are in the same position. I do think that paying off the loan seems quite unattainable because not only do I have to pay the student loan back, I also have to pay the interest fee on top per month.

“I’m glad I was lucky enough to go to university and get a degree as it helped me get into my current career but then I recently found out that it can work against me when applying for a mortgage. So I guess it is bittersweet.”

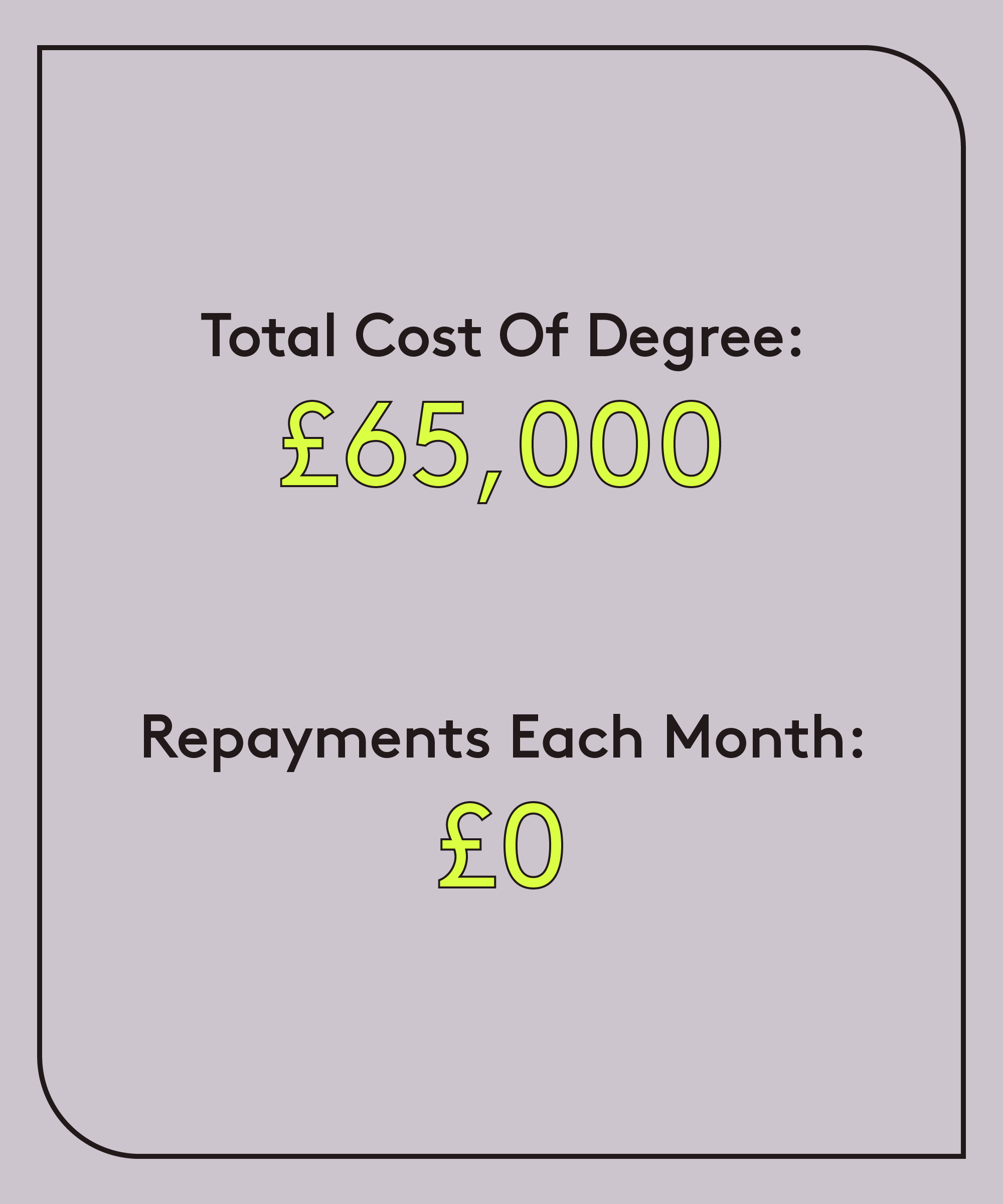

University: University of Cambridge (2013-2017)

Degree: Classics and education

Occupation: Freelance journalist

Total cost of degree: £65,000

Total owed:

Repayments each month: £0

Plan: 1

“I think that education is a universal right, and being university educated is a key part of social mobility in modern Britain. Therefore, it cannot be right in our society that the poorest students carry the highest amount of debt. It leaves graduates from poorer socioeconomic backgrounds paying effectively higher amounts of income tax than their wealthier counterparts, making their route out of poverty even harder.

“For university to be truly accessible, fair and equitable, tuition fees should be abolished universally — or at the very least abolished for those from poorer socioeconomic backgrounds, who are carrying eye-watering levels of debt which is constantly accumulating interest and making it harder to become socioeconomically secure.”

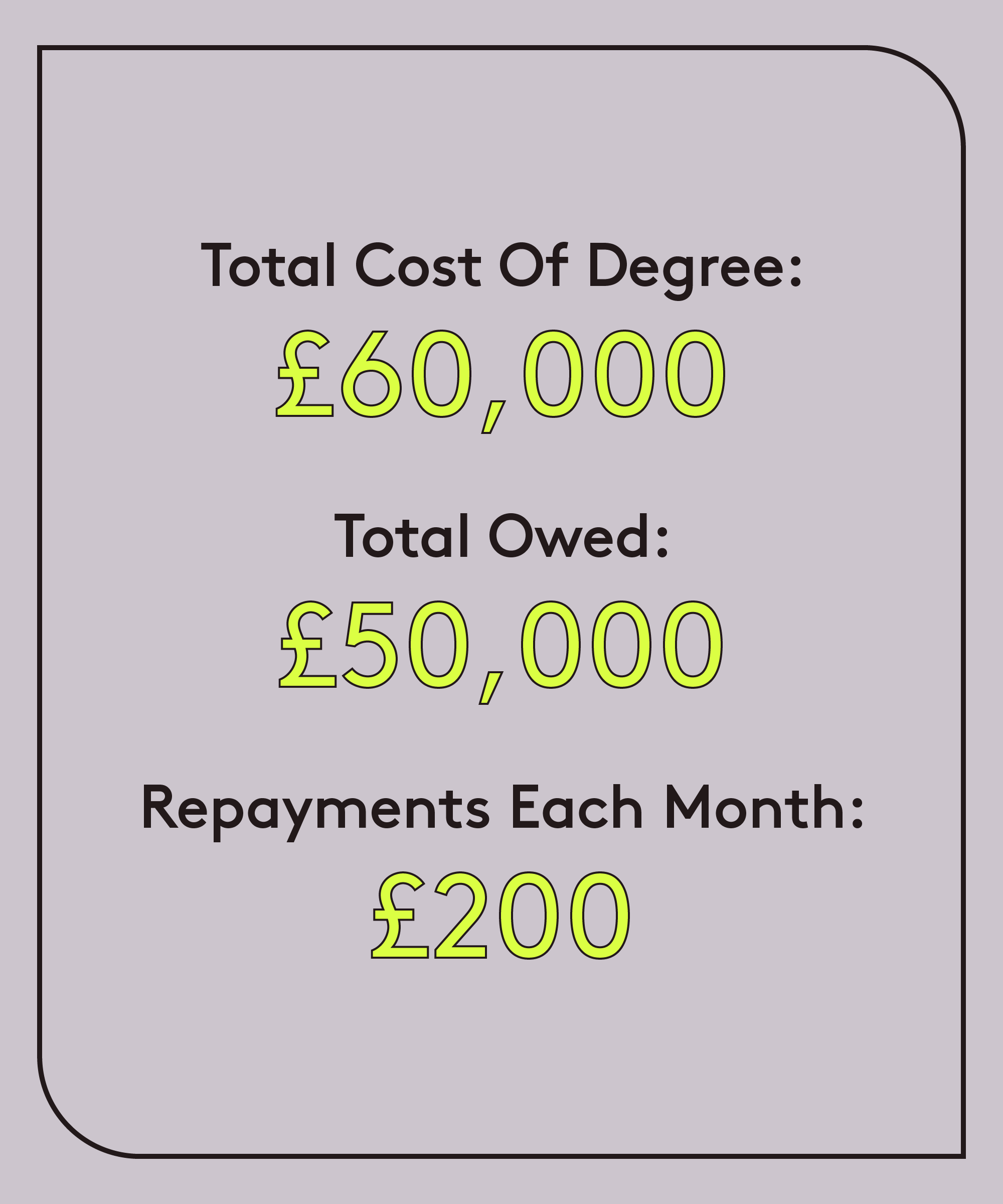

University: Kingston University (2013-2018)

Degree: Pharmacy

Occupation: NHS pharmacist

Total cost of degree: £60,000

Total owed: £50,000

Repayments each month: £200

Plan: 2

“It’s extortion! It’s completely unfair that we are taxed for pursuing higher education, particularly when the degree is in public service (medicine, pharmacy). When reviewing jobs for their salary, I can always predict that my actual take-home pay will be substantially less because of my student loan. It’s just a thorn in our brow that we have to bear.”

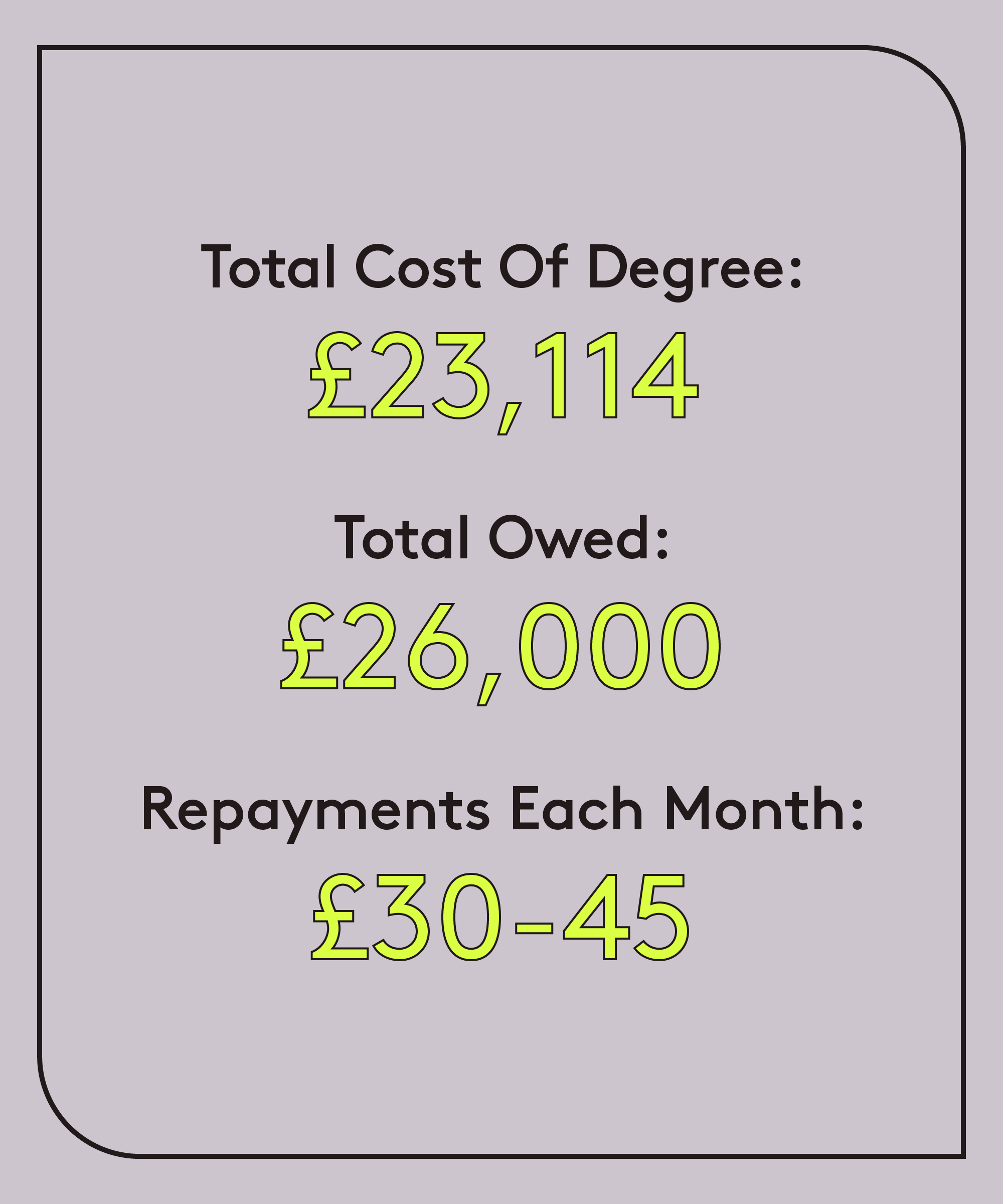

University: SOAS (2011-2015)

Degree: Middle Eastern studies & history of art / archaeology

Occupation: Recruiter

Total cost of degree: £23,114

Total owed: £26,000

Repayments each month; £30-£40

Plan: 1

“My attitude towards student debt now is that it’s a necessary evil for most people because without university education, you are limited in the jobs you will be eligible for. Additionally, I felt learning is an essential part of my life experience. However, now that I’m looking to buy a home which I can ill afford in London, I need to take this debt into consideration when applying for a mortgage.

“I’m also working towards saving to pay off this debt in annual chunks to avoid the interest. It’s basically like being given a small mortgage when you’re young, inexperienced and for me, a little ignorant.”

Like what you see? How about some more R29 goodness, right here?

Meet The Student Rent Strike Organisers